In a recent SEC filing, Micron Technology (MU) President and CEO Sanjay Mehrotra has disclosed plans to sell up to $20 million worth of his shares in the company. This comes after the conclusion of Mehrotra’s previous trading plan on August 8, 2024, covering the sale of up to 812,284 shares. MU stock was down over 1% at the time of writing.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

MU is a semiconductor company that provides memory and storage solutions.

A Closer Look at Mehrotra’s Stock Sale Plan

The stock sale is scheduled to begin in the first week of November, potentially involving the divestiture of up to 200,000 shares. Importantly, the shares being sold are those obtained through vested equity awards. Furthermore, the sale will be executed through the Mehrotra Family Trust, where Mehrotra serves as a trustee.

It should be noted that the stock sale is part of Mehrotra’s rule 10b5-1 trading plan. This plan allows key executives to pre-schedule stock sales, helping to avoid potential conflicts of interest related to insider information.

Is Micron Stock a Good Buy?

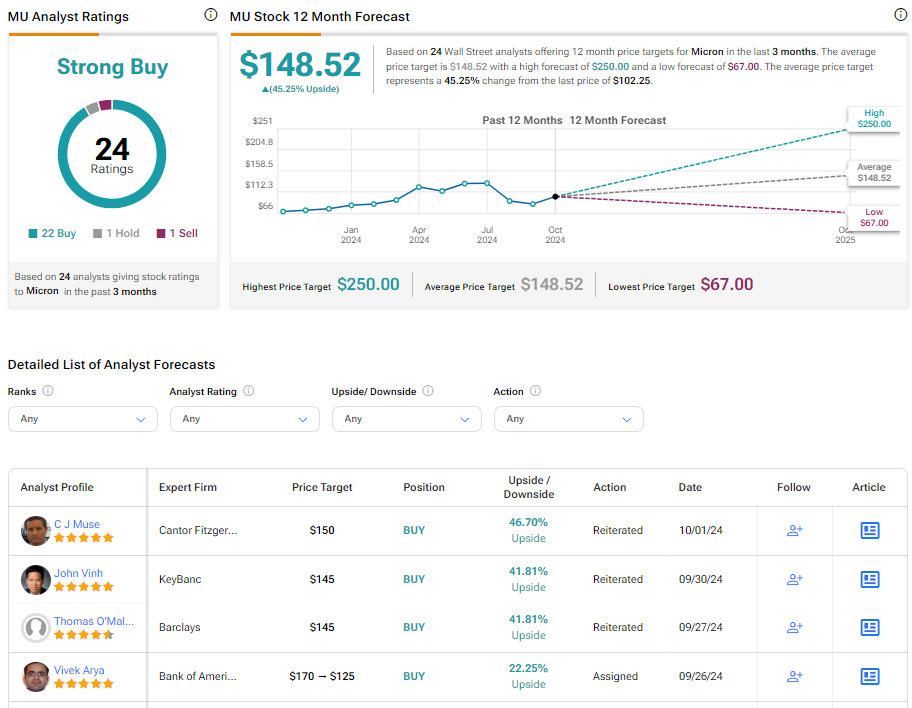

Turning to Wall Street, MU stock has a Strong Buy consensus rating based on 22 Buys, one Hold, and one Sell assigned in the last three months. At $148.52, the average Micron price target implies a 45.25% upside potential. Shares of the company have gained 20.04% year-to-date.