Liberty Latin America (NASDAQ:LILA) stock gained 4.5% in Monday’s pre-market trading. The upside came as two of the company’s corporate insiders purchased LILA’s shares for a total value of about $8.65 million.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

LILA is a telecommunications company that provides broadband, television, and mobile services in Latin American and Caribbean markets.

A Closer Look at the Insiders’ Trades

Director Paul Gould disclosed the purchase of 300,000 shares of LILA in multiple transactions between March 20 and March 22, at an average price of $6.55 per share. The total transaction value stands at $1.97 million.

Additionally, John C. Malone, a more-than-10% shareholder of Liberty Latin America, bought shares worth $6.69 million. As per the SEC filing, Malone bought 993,537 shares of LILA stock at an average price of $6.73 per share.

In contrast, Brian D. Zook, the Chief Accounting Officer at LILA, disclosed the sale of the company’s shares worth $187,235 on March 21.

Bullish Insider Trading Signal

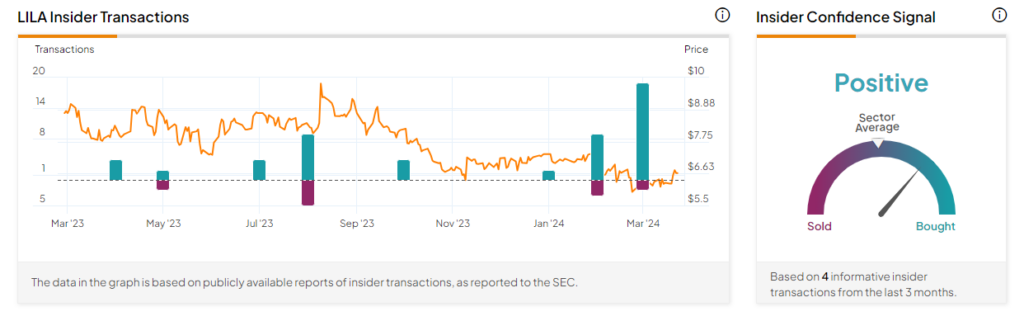

Overall, TipRanks’ Insider Trading Activity Tool shows that insider confidence in Liberty Latin America is currently Positive. Corporate insiders have bought LILA stock worth $8.6 million over the last three months.

Interestingly, TipRanks offers daily insider transactions as well as a list of top corporate insiders. It also provides a list of hot stocks that boast either a Very Positive or Positive insider confidence signal.

Is LILA Stock a Good Buy?

Monitoring insider trading activities can offer valuable cues for investors, helping them gauge the health and potential performance of a company. The share purchases by insiders reflect their confidence in LILA’s near-term growth prospects.

Furthermore, the company’s strategic initiatives for 2024, including the planned enhancements to its network infrastructure, especially its 5G capabilities, and the ongoing efforts to improve its digital platform, are expected to drive growth. However, intense competition from rivals such as T-Mobile (NASDAQ:TMUS) and high debt levels remain key concerns for the company.

Liberty Latin America stock is down 17.6% over the past six months.