Sylebra Capital Ltd., owner of more than 10% of IMPINJ’s (NASDAQ:PI) shares, has been buying PI stock over the past few days. The company manufactures radio-frequency identification devices and software.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

In the most recent SEC filing, the firm disclosed that it bought 190,569 shares of PI stock on August 16 at a weighted average price of $60.02 per share. The transaction’s total consideration stands at about $11.44 million.

Furthermore, on August 17, Sylebra Capital revealed that it purchased 225,182 shares of the company for a total value of $13.78 million. Additionally, the firm bought more shares of the company worth $3.85 million and $15.37 million on August 16 and 15, respectively.

It is worth mentioning that, upon completion of these transactions, Sylebra Capital now holds 3.59 million company shares, worth $206.64 million.

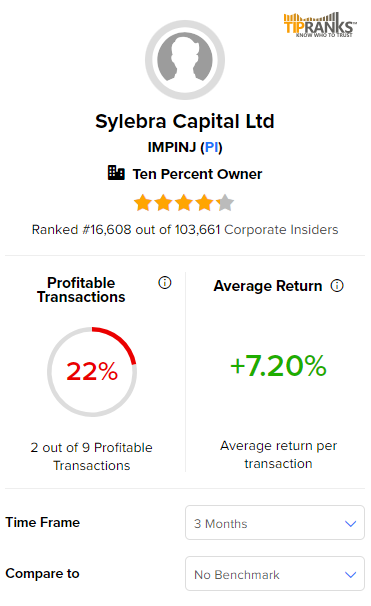

As per the data collected by TipRanks, the firm has had an unimpressive success rate of 22% in its transactions over the past three months. However, it has been able to generate an average return of 7.2% per transaction.

Bullish Insider Trading Signal

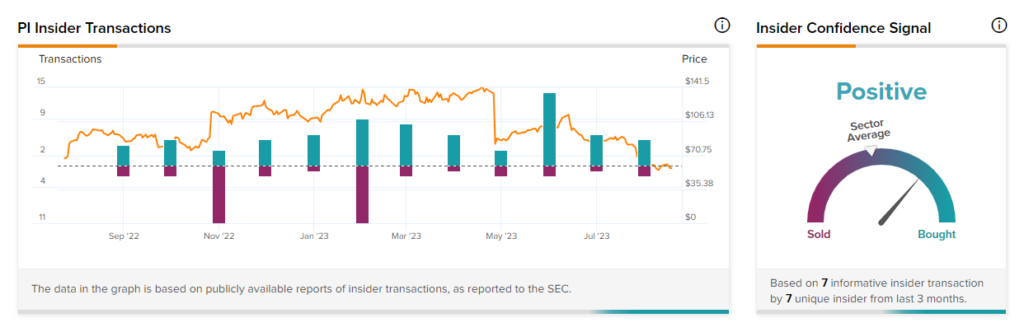

Overall, corporate insiders have bought PI shares worth $44.4 million over the last three months. TipRanks’ Insider Trading Activity Tool shows that insider confidence in IMPINJ is currently Positive.

Interestingly, TipRanks offers daily insider transactions as well as a list of top corporate insiders. It also provides a list of hot stocks that boast either a Very Positive or Positive insider confidence signal.

Is PI a Good Stock to Buy?

Considering the optimistic outlook from insiders, it would be prudent to anticipate significant positive developments in the company’s future. Nevertheless, analysts are cautiously optimistic about PI stock.

On TipRanks, PI stock has a Moderate Buy consensus rating based on six Buys and 1 Sell. The average stock price target of $90.86 implies 57.9% upside potential. Shares have tanked by 47.8% so far in 2023.