A top-rated insider at Exxon Mobil (NYSE:XOM) showed confidence in the company’s future by making an enormous purchase of the stock recently. As per the SEC filing, Jeffrey Ubben, one of XOM’s directors, bought 250,000 shares of the company on November 6. The total transaction value stands at $26.5 million.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Exxon Mobil produces and sells crude oil and natural gas, as well as a variety of energy products such as chemicals, plastics, and fuels.

Before the latest purchase, Ubben had bought XOM stock worth $69.41 million in early August 2023. These transactions represent the bullish outlook of the insider, who now owns over 2.09 million shares of Exxon Mobil stock valued at about $217.80 million.

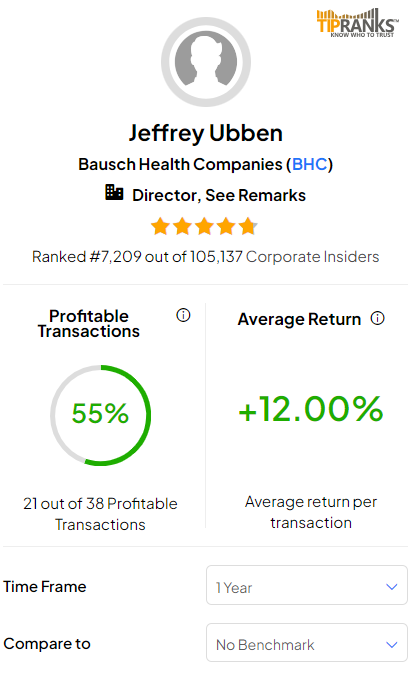

As per the data collected by TipRanks, Ubben has had a success rate of 55% over the past year, with an average return of 12% per transaction.

Neutral Insider Trading Signal

Overall, corporate insiders have bought Exxon Mobil stock worth $26.3 million over the last three months. TipRanks’ Insider Trading Activity Tool shows that insider confidence in the stock is currently Neutral.

Interestingly, TipRanks offers daily insider transactions as well as a list of top corporate insiders. It also provides a list of hot stocks that boast either a Very Positive or Positive insider confidence signal.

Is XOM Stock a Buy or Sell?

The company’s strong balance sheet, low operating costs, and diverse portfolio of assets keep it well poised for growth. Further, Exxon Mobil continues to invest heavily in new technologies that will help it reduce its carbon footprint and boost production.

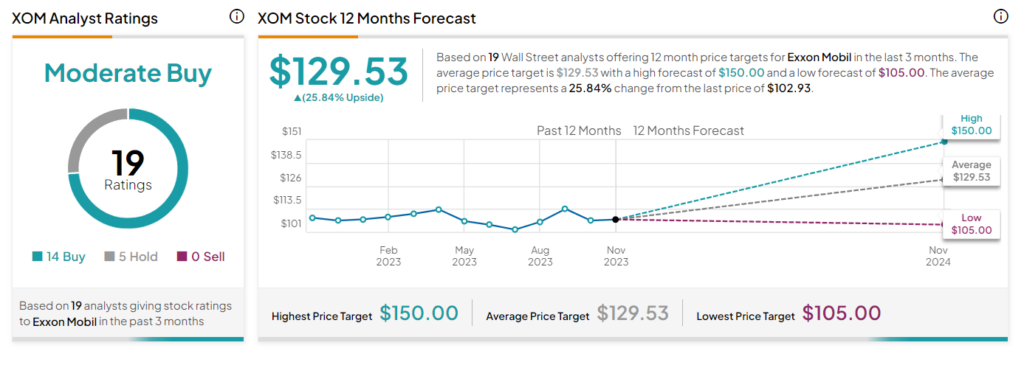

On TipRanks, XOM stock has a Moderate Buy consensus rating based on 14 Buys and five Holds. The average Exxon Mobil stock price target of $129.53 implies 25.84% upside potential. The stock is down about 1% so far in 2023.