Chipotle Mexican Grill’s (NYSE:CMG) Director, Gregg Engles, recently increased his stake in the company. The move reflects the insider’s confidence in the company’s near-term performance. The company operates fast-casual, fresh Mexican food restaurants throughout the U.S.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

In the recent SEC filing, Engles disclosed buying 877 shares of the company on December 15 at a weighted average price of $2,280 per share. The transaction’s total consideration stands at $2 million.

It is worth highlighting that Engles’ move is in contrast to that of Chipotle’s Chief Operating Officer, Scott Boatwright. On December 16, Boatwright disclosed selling off 1,300 shares of the company for $3.01 million.

Investors may benefit from keeping an eye on transactions made by key insiders, as these transactions typically reflect their confidence in the company’s prospects. Interestingly, TipRanks offers daily insider transactions as well as a list of top corporate insiders. It also provides a list of hot stocks that boast either a Very Positive or Positive insider confidence signal.

Recent Developments

It is noteworthy that Engles’ purchase comes after CMG recently announced plans to make early-stage investments in two companies through Chipotle’s $50 million Cultivate Next venture fund. The fund targets investments in businesses that support the expansion of its growth strategies.

It is important to mention that Chipotle has made investments in these two companies, one in Greenfield Robotics, a company dedicated to regenerative farming, and the other in Nitricity, a firm focused on addressing greenhouse gas emissions.

Is CMG Stock a Buy?

Chipotle has a long-term, ambitious plan to grow its store count to 7,000 in North America, which is supported by its strong cash flow. Moreover, the company has a loyal customer base, as reflected by 11.3% revenue growth in the last reported quarter despite higher prices.

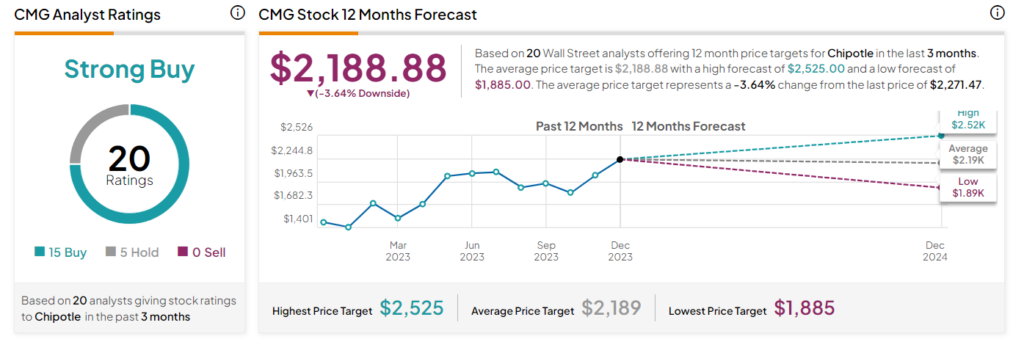

On TipRanks, CMG stock commands a Strong Buy consensus rating based on 15 Buys and five Holds. The average Chipotle price target of $2,188.88 implies a 3.6% downside potential.