Ace investor Warren Buffett’s Berkshire Hathaway (NYSE:BRK.A) (NYSE:BRK.B) has once again purchased shares of the oil and gas giant Occidental Petroleum (NYSE:OXY). With this latest round of purchases, Berkshire’s stake in Occidental has increased to about 27% from 25.8%.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

As per the recent SEC filing, Berkshire purchased over 10.4 million shares of Occidental in multiple transactions between December 11 and December 13. These transactions were made at prices ranging from $55.58 to $57.05, for an aggregate price of $588.6 million.

Following the latest buy, Berkshire now owns about 238.5 million OXY shares worth $13.6 billion, based on the closing price of $57.22 per share on Wednesday. It also owns $8.5 billion of Occidental preferred stock with an 8% dividend and about 83.9 million warrants to buy OXY common shares at $59.62 per share.

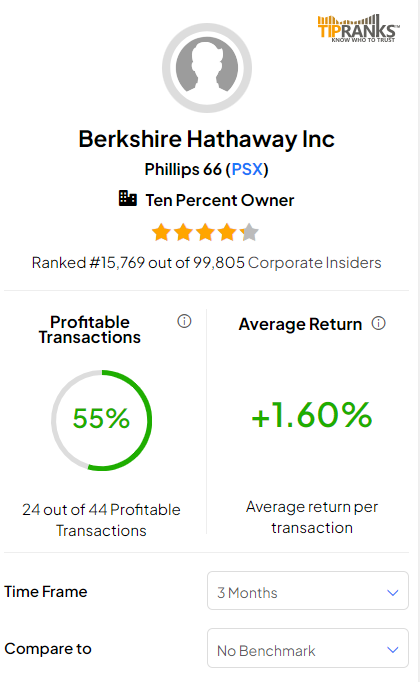

As per the data collected by TipRanks, Berkshire has had a 55% success rate in its 44 transactions in the past three months, with an average return of 1.6% per transaction.

Bullish Insider Trading Signal

Overall, TipRanks’ Insider Trading Activity Tool shows that insider confidence in the stock is currently Positive. Corporate insiders have bought Occidental stock worth $835 million over the last three months.

Interestingly, TipRanks offers daily insider transactions as well as a list of top corporate insiders. It also provides a list of hot stocks that boast either a Very Positive or Positive insider confidence signal.

Recent Updates

In a recent strategic move, Occidental announced plans to acquire Midland-based oil and gas producer CrownRock in a cash and stock deal valued at about $12 billion. With this acquisition, OXY expects to add around 170 thousand barrels of oil equivalent per day (Mboed) production next year.

It is worth mentioning that following the announcement, six analysts gave the stock a Buy while four analysts assigned a Hold rating. Among the bullish analysts, Devin McDermott from Morgan Stanley upgraded OXY stock’s rating to Buy from Hold. McDermott is optimistic about Occidental’s high-quality assets and attractive inventory.

What is the Future of OXY Stock?

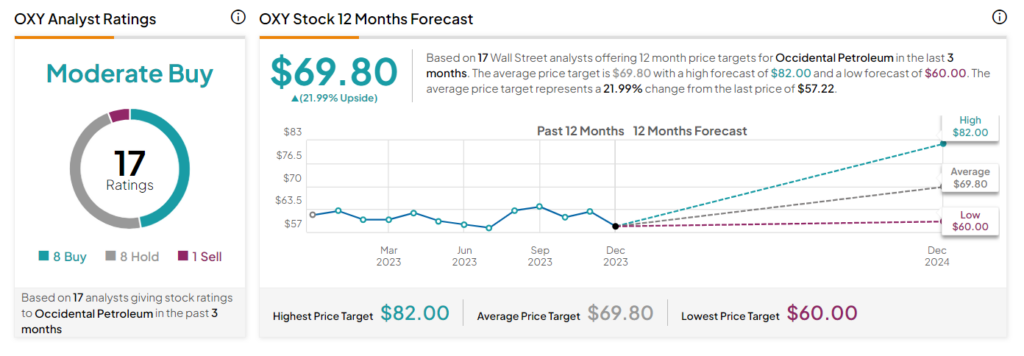

Overall, Wall Street analysts are cautiously optimistic about Occidental. It has a Moderate Buy consensus rating based on eight Buys, eight Holds, and one Sell. The average OXY stock price target of $69.80 implies 22% upside potential. The stock is down 5.2% so far this year.