Broadridge Financial (NYSE:BR) Corporate SVP Robert Schifellite recently exercised stock options to purchase the company’s shares worth $8.31 million. Typically, stock options are exercised when there’s an anticipation of future share value growth. Despite BR stock’s year-to-date rally of over 39%, Schifellite’s move suggests he sees further upside potential in the stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The company offers investor communication materials, including proxy statements, annual reports, quarterly reports, and various shareholder documents to public companies.

As per an SEC filing, Schifellite bought 70,181 shares of the company at a weighted average price of $118.47 per share on September 19. As a result of the recent transaction, he now owns BR shares worth $23 million.

TipRanks offers daily insider transactions as well as a list of top corporate insiders. It also provides a list of hot stocks that boast either a Very Positive or Positive insider confidence signal.

Factors Pointing to BR Stock’s Upside Potential

Broadridge reported strong fiscal fourth-quarter results in early August. It witnessed revenue growth of 9%, which was near the higher end of the company’s outlook. Additionally, the substantial 21% surge in adjusted earnings marked another highlight.

Broadridge’s effective cost management strategies, strong market position in its core proxy services business, and ongoing expansion into related areas are anticipated to provide sustained support to its performance.

Interestingly, based on TipRanks’ easy-to-read technical summary signals, the BR stock is a Buy in the one-day time frame. This is based on 11 Bullish, six Neutral, and five Bearish signals.

Is Broadridge Stock a Buy?

On TipRanks, BR stock has a Hold consensus rating based on one Buy, three Holds, and one Sell. However, the average stock price target of $174.20 implies 5.6% downside potential.

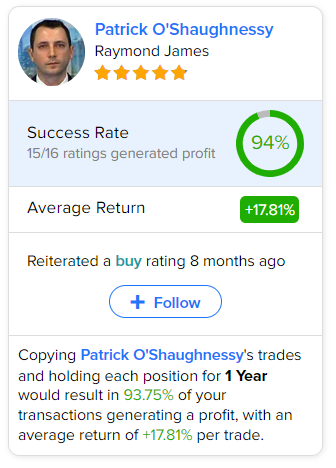

Interestingly, the most accurate and profitable analyst for BR stock is Raymond James analyst Patrick O’Shaughnessy. Copying the analyst’s trades on this stock and holding each position for one year would have resulted in 94% of your transactions generating a profit, with an impressive average return of 17.81% per trade.

Discover the insider trading tool driving results for investors