Ambrx Biopharma (NASDAQ:AMAM) stock gained about 7% in Wednesday’s pre-market trade after one of its corporate insiders revealed a huge purchase of AMAM shares. The clinical-stage biopharmaceutical company is known for utilizing an expanded genetic code technology platform to explore and develop Engineered Precision Biologics.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

One of the company’s more-than-10% owners, Cormorant Asset Management, bought 2.15 million shares on September 15 and September 18 at a weighted average price of $9.11 per share. The transaction’s total value stands at $19.61 million. After the latest purchase, the overall value of Cormorant’s holdings in AMAM stock stands at about $712 million.

As per the data collected by TipRanks, the investment manager has witnessed a 71% success rate in the past three months. Further, it has been able to generate an average return of 17.4% per transaction.

Interestingly, TipRanks offers daily insider transactions as well as a list of top corporate insiders. It also provides a list of hot stocks that boast either a Very Positive or Positive insider confidence signal.

Is AMAM Stock a Good Buy?

Ambrx’s innovative approach to cancer therapeutics, combined with promising preliminary results and strategic partnerships, positions the company favorably for future growth.

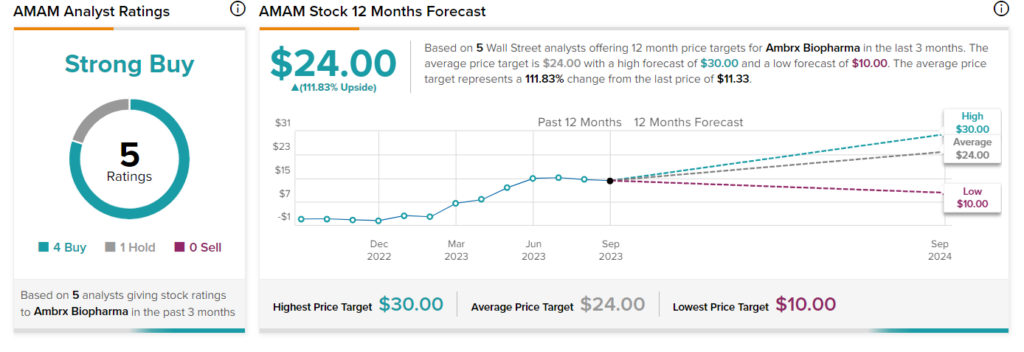

Turning to Wall Street, analysts have a Strong Buy consensus rating on AMAM stock based on four Buys and one Hold assigned in the past three months. Meanwhile, the average price target of $24 per share implies about 112% upside potential.