Clinical-stage biopharmaceutical company Molecular Templates (MTEM) has seen multiple informed key insider purchases over the past few weeks.

Whenever insiders such as top management, board members, or significant stake owners add to their holdings, it could be a very positive signal for retail investors.

While all information within companies may not be public, regulations stipulate the timely disclosure of trades that are executed by corporate insiders. This often provides retail investors with important insights into the financial health of the company.

Over the past three weeks, Biotech Target NV, which holds a more than 10% stake in Molecular Templates, has purchased MTEM stock in 6 separate transactions including one today to the value of about $1.29 million.

The total value of Molecular Templates shares purchased over that same period is about $12.58 million. The current market cap of the company is about $464.67 million.

An analysis by Tipranks of insider transactions in Molecular Templates stock over the past month indicates a positive insider confidence signal. Furthermore, the total value of the stock bought by corporate insiders in the last three months is about $32.98 million. (See Molecular Templates stock analysis on TipRanks)

On April 5, Jefferies analyst Roger Song reiterated a Buy rating on the stock and increased its target price to $20 (146% upside potential) from $18.

Molecular Templates recently reclaimed full rights to product candidate ‘169 for the treatment of multiple myeloma from Takeda.

Song commented that he likes, “the sole focus on next-gen ETB products-‘5111, ‘169, and ‘6402- as they should generate a bigger therapeutic window, based on molecular design and preclinical/clinical data.”

Further data for these 3 programs are expected in 2021, which Song believes potentially provide significant upside potential from current price levels.

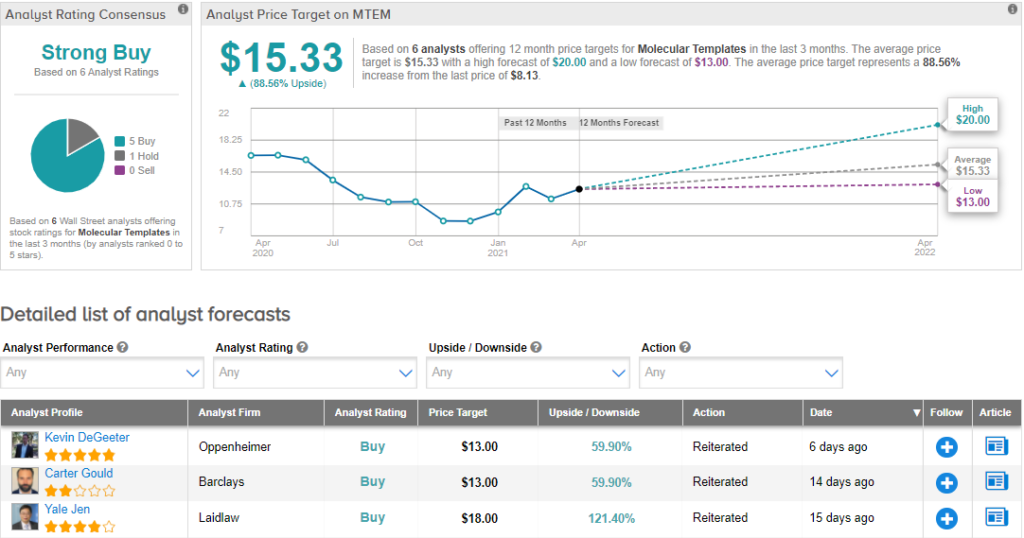

Consensus among analysts is that Molecular Templates is a Strong Buy based on 5 Buys and 1 Hold. The average analyst price target of $15.33 implies upside potential of 88.6%. Shares have dropped about 49.3% over the past year.

Related News:

Amazon Experiments With Furniture Assembly Service – Report

SeaSpine Holdings Prices 4.5M Public Offering At $19.50 Per Share Corporate Insiders Snap Up Shares of Liquidia Technologies