Innovative nuclear producer Cameco (CCJ) has been on a remarkable run, with shares soaring ~75% year-to-date and an eye-popping 921% over the past five years. Despite a softer third quarter in 2025, the uranium and nuclear fuel leader’s multi-year rally remains firmly supported by two powerful growth engines—both of which justify maintaining a Buy rating heading into November.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Cameco Delivers Muted Q3 Results

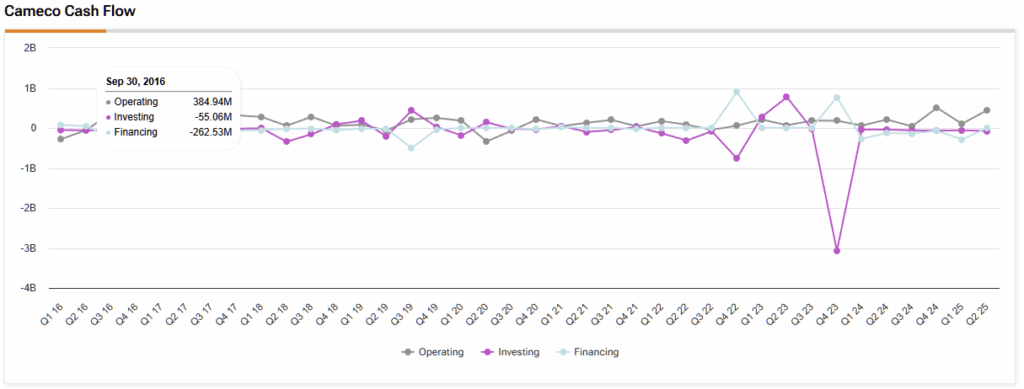

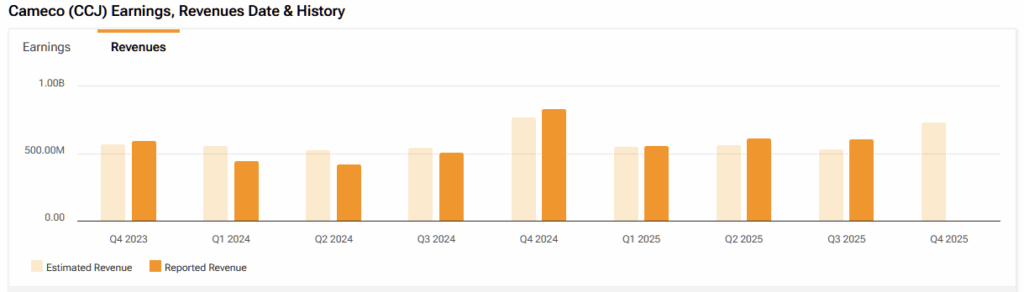

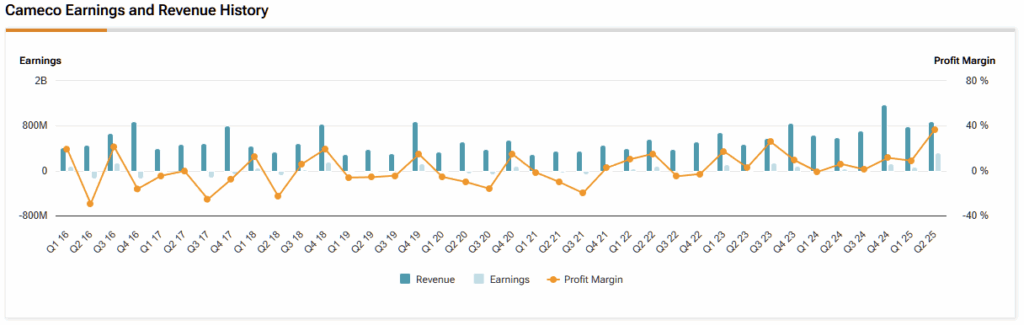

On the surface, Cameco’s Q3 2025 numbers, released earlier this week, appear mixed. Revenue of $615 million was 15% lower than in the same period last year, and the company generated no profit for the quarter. However, this is where it pays to look past the headline. Cameco’s sales are notoriously lumpy, as the timing of customer requirements can vary from quarter to quarter.

The real story is found in the company’s underlying profitability and long-term outlook. Adjusted net earnings for the quarter actually rose 33% year-over-year, and an adjusted earnings per share of $0.07 appears more respectable, towering 17% higher than last year’s. The nine-month picture is even clearer: revenues are up 17% to $2.3 billion, and adjusted earnings per share (EPS) have exploded by 203% to $0.94.

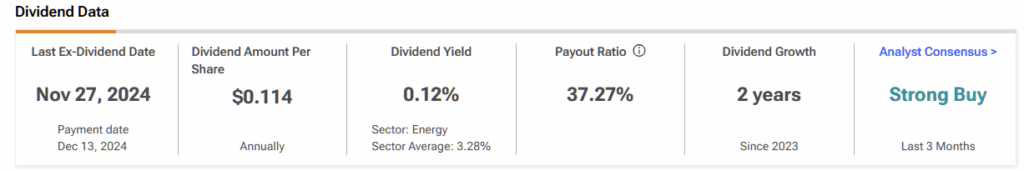

CCJ Adds Value with Dividend Surprise

With cash flow generation much stronger in 2025, supported by a lumpy dividend from Westinghouse last quarter, Cameco raised its annual dividend by a massive 118%, from $0.11 to $0.24 per share. This wasn’t just a token dividend increase; it was an acceleration of a payout target management had initially set for 2026.

In fact, the company has more than doubled its dividend ahead of schedule, and its future cash flows appear exceptionally secure. Looking past Cameco’s muted Q3 results reveals two powerful growth engines—one clearly visible to investors, and another that has remained largely hidden since 2014.

Growth Engine #1: The Westinghouse Powerhouse

Cameco’s 49% stake in Westinghouse Electric, acquired in November 2023, is already shaping up to be one of the most successful strategic moves in the nuclear energy sector in the past decade.

Together with Brookfield (51%), Cameco purchased Westinghouse for under US$8 billion. Fast forward two years, and the company is now at the center of a new strategic partnership with the U.S. government, which could pave the way for a potential IPO valued at more than US$30 billion by 2029. If realized, that valuation would represent a 275% potential capital gain—before even factoring in the substantial annual dividends Cameco already receives from the business.

This U.S. partnership could be a transformative catalyst. To secure its stake, the U.S. government must finalize contracts for at least US$80 billion in new Westinghouse reactor projects, effectively underwriting a multi-decade growth runway for the company.

Even before this development, Cameco’s management had projected 6–10% compound annual growth in adjusted EBITDA for Westinghouse. The additional US$80 billion in potential revenue could now accelerate earnings growth well into double-digit territory, reinforcing Westinghouse’s—and by extension, Cameco’s—position at the forefront of the global nuclear energy revival.

Growth Engine #2: The ‘Hidden’ Billion-Dollar Asset

Cameco’s Global Laser Enrichment (GLE) venture represents one of the company’s most underappreciated long-term assets. The 49%-owned joint venture with Australia-based Silex Systems is developing a laser-based uranium enrichment technology—a first-of-its-kind innovation that could reshape the global nuclear fuel landscape.

In 2014, following the post-Fukushima industry downturn, Cameco wrote off its entire C$183.6 million investment in GLE, recognizing a full impairment of the investment. As a result, this potentially transformative project still sits on Cameco’s balance sheet at a value of $0 today—despite its growing commercial promise.

That narrative is rapidly changing. In the first nine months of 2025, Cameco allocated the majority of its $24 million R&D budget to GLE, underscoring its strategic importance. The backdrop has also shifted dramatically: long-term uranium contract prices hit $85 in October, the highest since 2012, reflecting the sector’s renewed global momentum.

A major breakthrough arrived on October 22 when GLE announced it had successfully passed a critical third-party validation milestone—a development expected to trigger Cameco’s option to raise its ownership from 49% to 75%. As the commercial lead for GLE, Cameco appears to be ramping up spending to accelerate commercialization, with full-year R&D guidance of $47 million implying another $23 million in investment this quarter alone—more than double Q2’s expenditure.

GLE is now advancing toward a full-scale commercial enrichment facility in the United States, positioning itself as a potential Western alternative to Russia’s dominance in advanced nuclear fuel.

For Cameco, GLE represents a low-cost call option on a multi-billion-dollar enrichment market—a once-written-off asset now poised to become a central pillar of the company’s long-term growth story.

Demand Soars and Supply Tightens in Nuclear Raging Bull Market

Both of Cameco’s growth engines are being supercharged by a powerful macro tailwind. The global nuclear sector is experiencing a full-scale resurgence as nations race to adopt clean, reliable energy solutions—not only to meet 2050 climate targets, but also to power the explosive growth of AI-driven data centers.

This surge in demand is colliding with a tightening supply landscape. The world’s largest uranium producer, Kazatomprom, recently cut its 2026 production guidance, while Cameco also trimmed its 2025 outlook due to mine development delays. The result: a rapidly tightening market that has driven long-term uranium contract prices to US$85 per pound in October—the highest level since 2012.

In this environment, Cameco stands at the center of a historic supply-demand imbalance that could continue to propel the company’s earnings power for years to come.

Is Cameco a Good Stock to Buy?

Cameco stock attracts a Strong Buy rating on Wall Street based on 14 unanimous Buy ratings issued by best-performing analysts during the past twelve months. The average analyst price target of $105.86 suggests ~9% upside potential over the next 12 months.

The Tricky Question of Valuation

This brings us to a discussion on valuation. After a 75% run-up this year, Cameco stock is not cheap. Shares trade at a forward P/E ratio of nearly 90x, which is significantly above the sector median of 13x.

However, P/E ratios can be misleading. When you factor in the company’s explosive earnings growth outlook, the picture changes. Cameco’s forward price-earnings-to-growth (PEG) ratio of 1.2 is actually below the sector average of 1.4, suggesting its premium valuation is fair given its future earnings growth prospects.