LiDar sensors and perception software provider Innoviz Technologies (NASDAQ:INVZ) has announced a lower-than-expected set of first-quarter numbers.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Revenue declined by nearly 44% year-over-year to $1.01 million, missing expectations of $1.42 million. Further, the net loss per share at $0.26 came in wider than expectations by $0.05. The drop in revenue was attributable to lower revenue from the BMW program. This impact was partially offset by a rise in the sales volume of InnovizTwo sample units.

Importantly, the company noted that a current global automotive client is looking to expand its use of InnovizTwo LiDar for a new light commercial vehicle program. Financial contributions from this program are expected to begin this year itself and buoyed by this development the company has provided an upbeat outlook for 2023.

Innoviz now expects revenue for the year to land between $12 million and $15 million. Further, total new NRE bookings are anticipated between $20 million and $40 million alongside the addition of one to three programs with current clients.

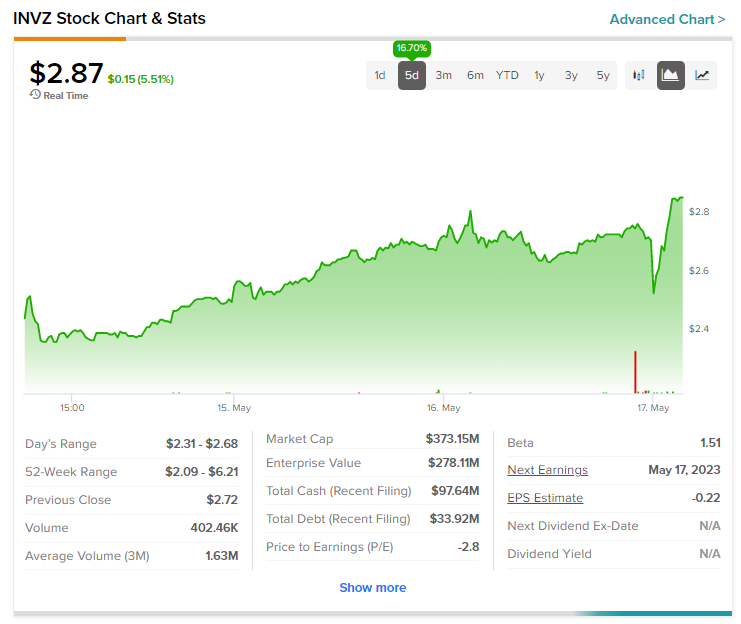

Shares of the company have now surged nearly 16.7% over the past five sessions alone.

Read full Disclosure