Shares of medical technology company InMode (NASDAQ: INMD) plunged on Thursday after announcing preliminary Q3 results and lowering its guidance for FY23. InMode now expects revenues to be in the range of $500 million to $510 million, lower than its prior forecast of between $530 million and $540 million.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

For Q3, the company expects to generate revenues in the range of $122.8 million to $123.0 million, below analysts’ estimates of $137 million. Adjusted earnings are estimated to be between $0.59 and $0.60 per share, again missing Street estimates of $0.67 per share.

The firm stated in its press release that its sales may be impacted this year due to the economic slowdown. InMode added, “In part, this downtick constitutes a return to “normal” third-quarter seasonality, slower purchase decisions due to lower aesthetic activity during the summer. Moreover, constraints in financing of medical equipment, marked by higher interest rates, tighter leasing approval standards, and bottlenecks in loan processing, have also dampened InMode platform sales activity worldwide.”

InMode expects to announce its third-quarter results on November 2.

What is the Forecast for InMode Stock?

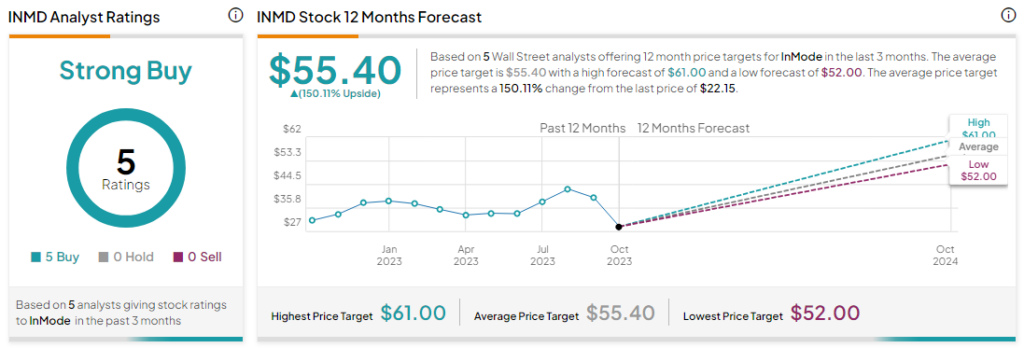

Overall, analysts remain bullish about InMode, with a Strong Buy consensus rating based on five unanimous Buys. The average INMD price target is $55.40, implying an upside potential of 150.3% from current levels.