Ingersoll Rand, Inc. (IR) inked an agreement to acquire Maximus in an all-cash transaction worth C$135.4 million, to capture the huge growth potential in the agritech and industrial water treatment end markets.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Shares of Ingersoll Rand, a global flow creation and industrial solutions company, have jumped 72% over the past year.

Based in Montreal, Canada, Maximus provides digital controls and Industrial Internet of Things (IIoT) production management systems for the agritech market.

Maximus’ IIoT platform connects to farm devices, simplifies facility management, tracks the status of farm infrastructure, and automates tasks based on artificial intelligence (AI) technology. (See IR stock chart on TipRanks)

Notably, Maximus has witnessed an impressive revenue CAGR of 30% over the past five years and continues to expect double-digit growth over the next five years. It recently reported annual revenue of C$40 million.

Also, Maximus is forecast to achieve adjusted EBITDA margins in line with the current momentum in the Precision and Science Technologies Segment (PST) levels.

The addition of Maximus will enhance digital connectivity to Ingersoll’s Dosatron smart dosing pump system in the PST segment. The collaboration will lead to better dosing precision, efficiency, data gathering, and record keeping.

Upon integration with Ingersoll Rand’s PST segment, the company expects to achieve significant margin improvement and a high single-digit EBITDA multiple (excluding flow-through from organic growth) by the end of the third year.

Important to note, the agritech market is expected to grow by double-digits annually in the next five years. Ingersoll Rand intends to leverage both Dosatron and Maximus channels, to drive growth and gain market share with minimal customer overlap.

Ingersoll Rand’s CEO, Vicente Reynal, commented, “Smart, connected products, digital capabilities, and technology are core to our growth. Today’s announcement delivers on our commitment to deploy capital in pursuit of this strategy.”

The acquisition is expected to close during the third quarter, subject to mandatory regulatory approvals.

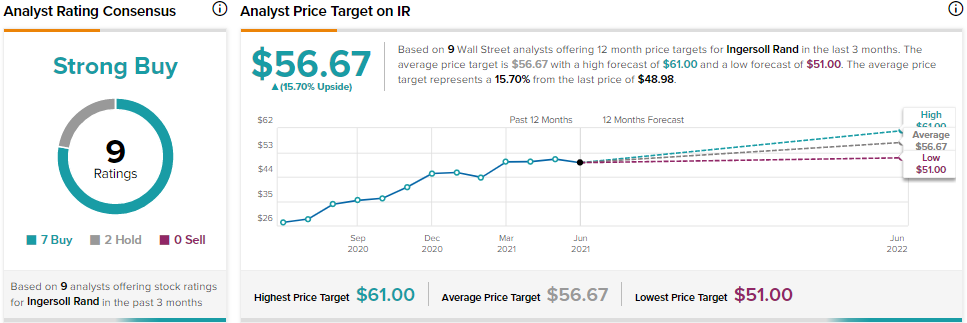

Robert W. Baird analyst Michael Halloran maintained a Buy rating on the stock with a price target of $61 (25.6% upside potential).

Halloran believes that IR remains a favorite pick, following the company’s recent acquisition of Seepex, a manufacturer of progressive cavity pumps.

Overall, the stock has a Strong Buy consensus rating based on 7 Buys and 2 Hold. The average analyst Ingersoll Rand price target of $56.67 implies 15.7% upside potential from current levels.

Related News:

CalAmp Posts Mixed Results; Shares Open 6% Lower

Upland Software Snaps up Panviva; Raises Guidance

Synopsis Announces $175M Share Repurchase Program, Collaboration with Samsung