Spirit Airlines (NYSE:SAVE) has delivered a better-than-anticipated third-quarter performance, with EPS of -$1.37 coming in narrower than estimates by $0.11. Further, revenue of $1.26 billion outpaced estimates by $10 million, despite a 6% year-over-year decline. Nonetheless, broader industry challenges are weighing on the airline.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

During the quarter, Spirit experienced soft product demand and pressures from discounted fares. Moreover, the airline does not anticipate demand and pricing normalization during the peak holiday season. Total revenue per ASM (TRASM) in Q3 declined by 17.4% to $0.0914, and total revenue per passenger flight segment decreased by 13.5% to $116.43.

On top of tepid demand, Spirit is also witnessing challenges from higher fuel prices. Consequently, the company expects sequentially lower margins in the fourth quarter. To improve its performance, Spirit is working on achieving structural cost reductions to the tune of $100 million.

Owing to these dynamics, Spirit is slowing down its short-term capacity growth. Ted Christie, the President and CEO of Spirit, noted, “We continue to believe merging with JetBlue (NASDAQ:JBLU) and creating a viable competitor to the Big Four airlines is in the best interest of consumers, team members, and shareholders.”

Last week, Spirit’s shareholders approved its merger with JetBlue, and the transaction is anticipated to close no later than the first half of 2024. However, the U.S. Justice Department is seeking to block the merger, with a trial slated to begin on October 31.

What Is the Forecast for SAVE Stock?

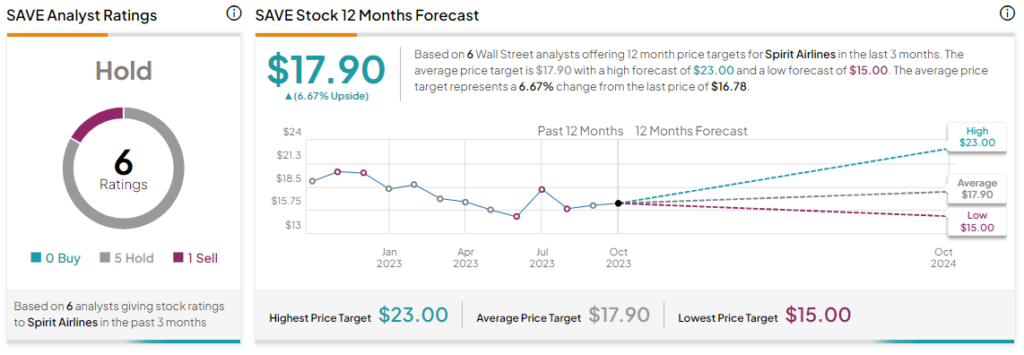

Overall, the Street has a Hold consensus rating on Spirit. The average SAVE price target of $17.90 implies a modest 6.7% potential upside.

Read full Disclosure