Shares of the UK-based Indivior PLC (GB:INDV) tumbled by almost 16%, as the company issued a profit warning after its rival’s anti-opioid drug gained traction. The company continues to project the opioid use disorder treatment SUBLOCADE’s peak net revenue at over $1.5 billion, but no longer expects to achieve a $1 billion run rate by the end of 2025. Indivior now expects its adjusted operating profit to fall between $260 million and $280 million in FY24, down from the earlier forecast of $285 million to $320 million.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Indivior is a global pharmaceutical company focused on developing treatments for addiction and serious mental health conditions.

Indivior Lowers Sales Outlook Amid Competitive Pressure

Indivior reported lower-than-expected preliminary Q3 numbers, citing increased competitive pressures, delays in funding, and subdued trade stocking. The company said that it is witnessing quicker-than-expected initial uptake of the competitor’s product compared to SUBLOCADE. Furthermore, as the U.S. market adapts to two long-acting injectables (LAI) products in the coming year, Indivior expects ongoing pressure on SUBLOCADE’s volume growth.

The company’s preliminary Q3 net revenue for SUBLOCADE is projected to be between $187 and 192 million. Meanwhile, the full-year net revenue forecast is downgraded to $725 to $745 million from $765 million to $805 million.

The company further stated that it is working to improve efficiency to boost SUBLOCADE’s growth and keep profit margins steady.

Is Indivior Stock a Good Buy?

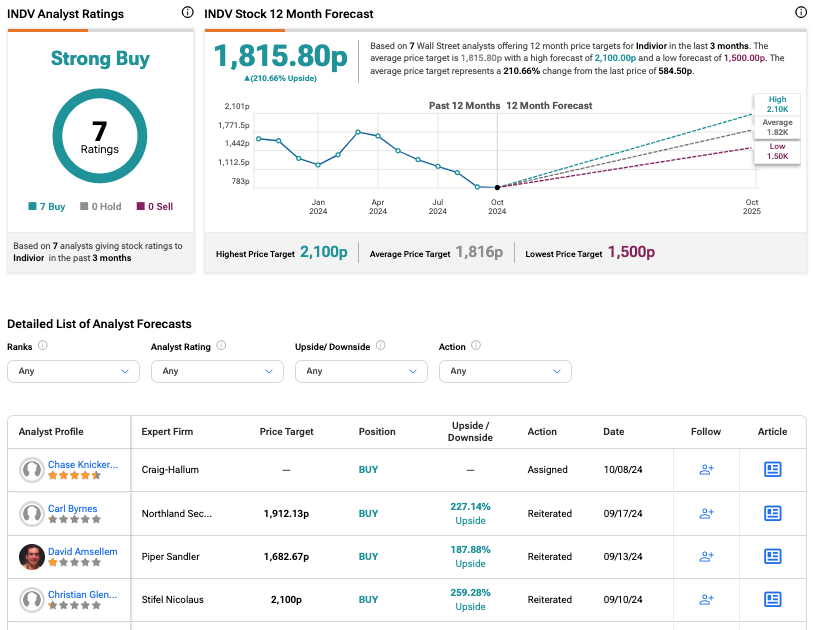

INDV stock has lost over 60% in trading in the last 12 months. Nonetheless, analysts remain bullish and expect a rebound in the share price. Most recently, analyst Chase Knickerbocker from Craig-Hallum assigned a Buy rating to INDV stock.

On TipRanks, INDV stock has been assigned a Strong Buy rating based on seven Buy recommendations. The Indivior share price target is 1,815.80p, which is 210.7% above the current level. The price target has a high estimate of 2,100p and a low estimate of 1,500p.