The International Monetary Fund (IMF) just delivered a gut punch to global growth expectations. In its April 2025 World Economic Outlook, the IMF cut global growth forecasts to 2.8% for this year, down from 3.3% in January. The culprit? U.S. tariffs hitting century-high levels and the fallout spreading fast across the globe.

U.S. Tariffs Spark Global Downgrades

The IMF didn’t pull punches. The new tariff regime, spearheaded by the U.S., has reached levels not seen in 100 years. Those tariffs are sending ripple effects through the global economy. They are hammering trade flows and raising costs everywhere from China to the Eurozone.

The Eurozone now faces 0.8% growth for 2025, cut sharply from previous projections. The U.K. got hit harder, with the IMF slicing its growth forecast by 0.4 percentage points. Meanwhile, China faces a steeper climb too, with trade frictions weighing on its export-heavy economy.

But emerging markets might have it worst. Tighter global funding conditions and reduced development aid could push these nations deeper into debt, the IMF warns.

Inflation Slows but Risks Grow

Headline inflation is cooling, but not as fast as the IMF expected back in January. While that offers a thin silver lining for consumers, the real storm clouds are gathering around financial markets. The IMF flagged the risk of tighter global financial conditions if policy shifts continue at this pace. That could trigger capital outflows, especially in vulnerable emerging economies.

IMF Flags Rising Social Unrest and Demographic Pressures

Here’s what slipped through the cracks. The IMF also flagged social unrest as a growing risk. The lingering cost-of-living crisis could reignite tensions, particularly in regions where Fiscal buffers are thin. And don’t forget demographics. Aging populations, especially across advanced economies, threaten to strain budgets and slow growth further.

But there’s a way out. The IMF recommends boosting labor force participation among older workers and women, and integrating migrants and refugees more effectively to lift productivity. These structural reforms could ease fiscal pressures and unlock long-term growth potential.

Nasdaq Shows Resilience amid Global Uncertainty

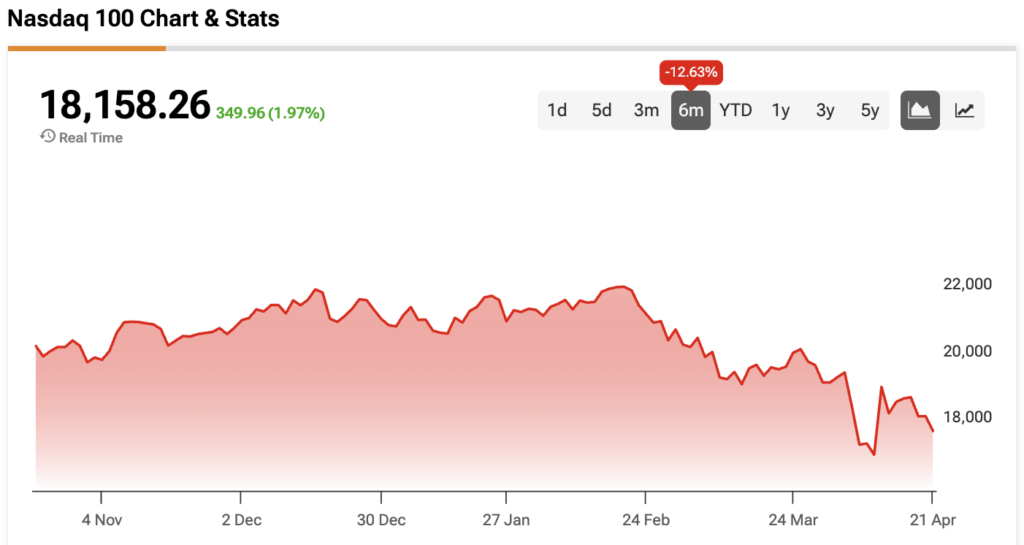

The IMF’s forecast paints a grim picture. But equity markets tell a messier story. The Nasdaq 100 (NDX) has bounced between sharp rallies and steep pullbacks. This reflects just how unsettled the market feels right now. As of today, the Nasdaq 100 sits at 18,158, according to TipRanks data. That’s a 12.63% drop over the past six months, despite a recent 1.97% daily bounce. But the index has swung sharply over the past month, driven by mixed earnings, shifting rates, and global trade fears.

The IMF’s forecast shows a world under pressure. The Nasdaq 100 (NDX) hasn’t offered much comfort either. The index has ricocheted between gains and losses, never quite finding solid ground. As of today, the Nasdaq 100 sits at 18,158. That’s a 12.63% drop over the past six months, despite a recent 1.97% daily bounce. In the past six months, it has dropped 12.63%, according to TipRanks data. That includes sharp climbs and even steeper drops.

This kind of back-and-forth shows just how fragile investor sentiment is right now. Even tech giants can’t fully shield the index. Another rate hike or deeper trade shocks could send it spinning again. A TipRanks graph of Nasdaq’s recent performance shows just how bumpy the ride has been.

Overall, it’s important to note that the IMF’s forecast cuts aren’t just about tariffs. They reflect a world grappling with trade wars, shifting policies, demographic headwinds, and brewing social unrest.

The outlook looks tough, but policymakers could help make the path smoother—if they’re willing to roll up their sleeves and tackle the hard stuff head-on.