Entertainment company IMAX Corporation (NYSE:IMAX) announced that it intends to own 100% of its Chinese subsidiary. The move will provide operational flexibility for the company to pursue new growth opportunities in the Chinese market. Following the announcement, IMAX stock gained over 2% in after-hours trade.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

IMAX’s Chinese subsidiary was established in 2011. The company said that it plans to acquire the outstanding 96.3 million shares in IMAX China, its Hong Kong-listed subsidiary, for HK$10 per share in cash. The offer price indicates a premium of about 49% compared to the average closing price of the past 30 days. It expects to fund the transaction through internal cash and external debt financing.

Acquisition Benefits

Commenting on the proposed acquisition, IMAX CEO Rich Gelfond said, “This deal is a win-win for IMAX Corporation and IMAX China,” as it will unlock significant financial benefits for both parties. IMAX China investors will receive a considerable premium to the current market price.

Meanwhile, the deal is expected to be accretive to IMAX Corporation immediately. It will lift its adjusted EBITDA, generate approximately $2 million in annual cost savings, and result in potential tax efficiencies.

Following the announcement on July 12, Rosenblatt Securities analyst Steve Frankel said that the acquisition would be “immediately accretive” to the company’s earnings. Further, the analysts reiterated a Buy on the shares of IMAX, citing the “strong slate of upcoming Hollywood and local language titles” and its current valuation.

Is IMAX a Good Stock to Buy?

IMAX stock has seven Buy, one Hold, and one Sell recommendations on TipRanks, translating into a Moderate Buy consensus rating. Analysts’ 12-month average price target of $24.88 implies 45.67% upside potential from current levels.

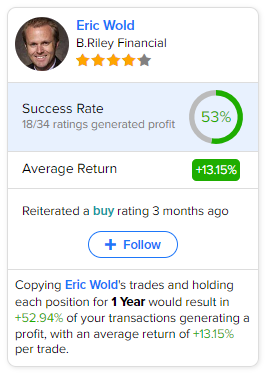

Investors should note that Eric Wold of B. Riley Financial is the most accurate analyst for IMAX stock, according to TipRanks. Copying Wold’s trades on IMAX stock and holding each position for one year could result in 53% of your transactions generating a profit, with an average return of 13.15% per trade.