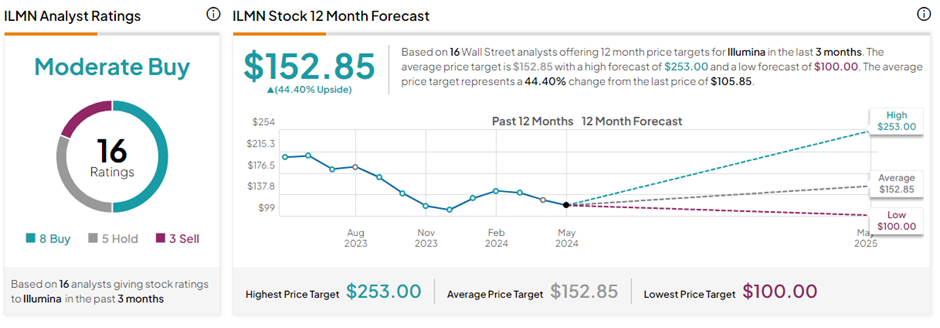

American biotechnology company Illumina (NASDAQ:ILMN) could offer a 44.4% upside potential in the next twelve months, as per Wall Street’s average price target. Analysts are cautiously optimistic on this S&P 500 (SPX) stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Illumina develops DNA sequencing and array-based life sciences technologies, with a focus on pioneering advances in oncology, genetic and infectious diseases, reproductive health, and beyond. In the past year, ILMN shares have lost 50.2%.

Illumina Prioritizes Margin Improvements

In Q1 FY24 results, Illumina reported adjusted earnings per share (EPS) of $0.09, which was one cent higher than the prior-year quarter and exceeded the consensus of $0.04. Consolidated revenue of $1.08 billion fell 1% year-over-year but came in marginally better than the consensus of $1.05 billion.

Core Illumina (excluding Grail) revenue declined 1.8% year-over-year while gross margins improved to 65.7% from 63.8% in Q1 FY23. At the same time, operating margin fell to 11% from 13.2% in the prior-year quarter. Meanwhile, Grail reported a 35% year-over-year jump in revenue to $27 million in Q1.

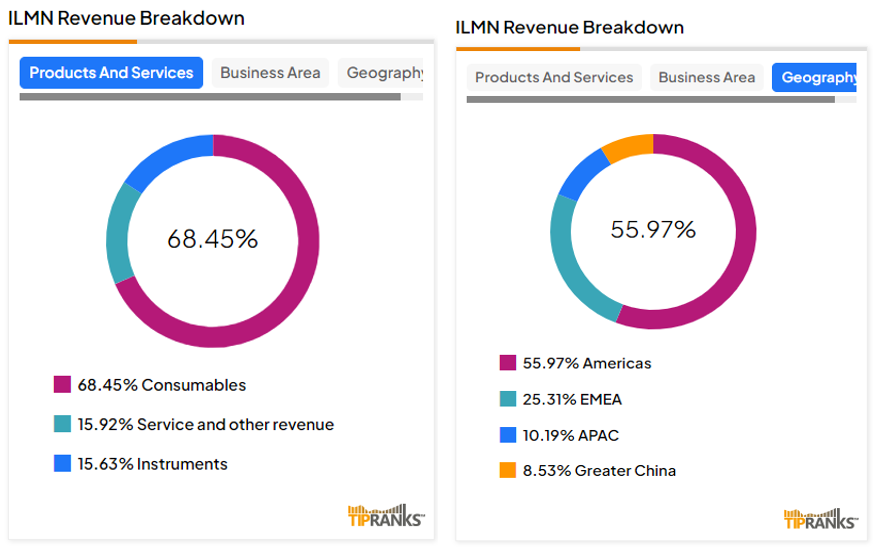

Illumina generates over 68% of its revenues from the sale of Consumables, 15.6% from the sale of Instruments (both combined as Product Revenue), and the remaining 15.9% from Service and other revenues.

Illumina has a solid global presence. Interestingly, more than half of Illumina’s revenues come from the Americas, followed by Europe, the Middle East, and Africa (EMEA), Asia Pacific (APAC), and Greater China.

Illumina’s Grail Divestment Plans

Illumina’s 2021 acquisition of cancer screening test maker Grail has consistently been on the regulator’s radar for its anticompetitive nature. The European Commission finally approved Illumina’s divestiture of Grail, which may take the form of a separately listed company or a complete sale to a third party. In any case, existing Illumina shareholders are bound to benefit from Grail’s divestment.

Illumina has filed a Form 10 registration statement with the Securities and Exchange Commission (SEC), giving details of Grail’s financials and business prospects. Illumina intends to finalize the divesture terms of Grail by the second quarter of 2024.

What is the Future of Illumina Stock?

Wall Street analysts are cautiously optimistic about Illumina’s stock trajectory with Grail’s divestiture hanging in the balance and overall weak financial performance for Core Illumina.

TD Cowen analyst Daniel Brennan maintained his Hold rating on ILMN stock after attending Grail’s Capital Markets event. Importantly, Brennan believes that the chances of spinning off Grail into a publicly listed company are higher and ILMN shareholders are poised to get a stake in Grail in the form of a dividend. Brennan has a price target of $140 on ILMN, implying 32.3% upside potential from current levels.

Similarly, Leerink Partners analyst Puneet Souda maintained a Buy rating on ILMN stock, citing multiple levers. Souda is encouraged by Illumina’s strategic spinoff of Grail (withholding a minority stake) and robust growth prospects. Souda sees a greater possibility of success of the anticipated NHS trial readout for Galleri, which is expected to drive Illumina’s performance higher.

Overall, ILMN stock has a Moderate Buy consensus rating based on eight Buys, five Holds, and three Sell recommendations on TipRanks. The average Illumina price target of $152.85 implies 44.4% upside potential in the next twelve months.

Ending Thoughts

Illumina is at a strategic juncture of its business with the divestment of Grail on the cards. Analysts are cautious about the stock’s trajectory over the near term. That said, the expected positive results from Galleri and the potential for future growth from Illumina’s cancer-detecting tests bode well for ILMN stock in the long run.