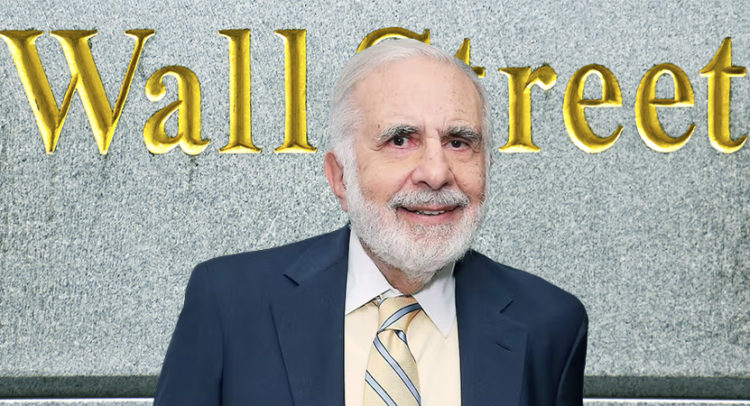

As the saying goes, “Old is Gold,” a lot of companies that are undergoing strategic changes are bringing back their old CEOs to navigate the companies through the challenges. On March 13, shares of Illumina (NASDAQ:ILMN) plunged on the news that activist investor Carl Icahn may lock horns in a proxy fight. After failed attempts, Icahn is now pushing to bring back former CEO Jay Flatley to take the reins of the biotechnology company. ILMN stock ended the day up 3.8% on the news.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

In a recent interview, billionaire investor Icahn prompted bringing back Flatley as Illumina faces the critical task of divesting a cancer-test developer, Grail, acquired in 2021. Illumina’s acquisition of Grail had antitrust concerns, yet the gene sequencing company went ahead with the deal. “This is an urgent moment for the company and they need someone who knows what they’re doing to fix the situation,” Icahn said of bringing back Flatley.

The Grail deal was accomplished under current CEO Francis DeSouza’s supervision, and hence, Icahn naturally wants him out. Flatley also blames DeSouza for overpaying for the Grail acquisition. Thus, it is highly likely both Icahn and Flatley share the same sentiment about the deal.

On the one hand, Illumina thinks that Grail will be of tremendous value once its cancer-testing blood screeners prove successful by 2024. Icahn, on the other hand, believes that retaining Grail may prove to be costly for Illumina. “They don’t have the money, and especially in this environment, they won’t be able to keep funding this money-losing business,” Icahn said.

Icahn also suggested possibilities for liquidating Grail. One of the most preferred ones is through a “rights offering” to Illumina’s current shareholders. “It’s a way to allow Illumina shareholders to get the benefit of buying Grail at a possible bargain price or sell their rights and get a benefit in this fashion,” Icahn concluded.

Icahn’s strategy follows the recently announced comeback of Bob Iger as CEO of The Walt Disney Company (NYSE:DIS). Similarly, Swiss investment banking giant UBS Group (NYSE:UBS) is bringing back former CEO Sergio P. Ermotti to lead the bank as it navigates through the acquisition of failed lender Credit Suisse (NYSE:CS). The basis for bringing back former CEOs to tackle challenging situations is simple: they have “been there, done that” and have been instrumental in the past in making the companies reach their current grandeur.

Is ILMN a Good Stock to Buy?

On TipRanks, ILMN stock has a Hold consensus rating as analysts await a plausible outcome for the Grail divestment and settlement with Icahn’s proxy fight. Further, the average Illumina price forecast of $238.29 implies 7.3% upside potential from current levels. Meanwhile, the stock has gained 10.5% so far in 2023.