Shareholders of the world’s largest gene sequencing company Illumina, (NASDAQ:ILMN), have proven their disapproval of the board’s past decisions by ousting Chairman John Thompson at the annual shareholder meeting yesterday. Instead, they voted in favor of activist investor Carl Icahn’s nominee, Andrew Teno, marking a first-of-its-kind victory for activism at a company of this scale. Following the news, ILMN stock fell to its lowest lows since 2023 and ended the day down by nearly 9%.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Further, shareholders held their votes for the other two nominees of Icahn, owing to which Illumina’s current CEO Francis DeSouza and director Robert Epstein were re-elected to their posts. The new chairman of the board will be selected later. Additionally, shareholders voted against the company’s 2022 compensation packages, which included awarding DeSouza $26.7 million in total pay.

Icahn currently owns roughly 1.4% of ILMN. However, his proxy battle with Illumina has been long-standing, with the heart of the matter being Illumina’s 2021 purchase of Grail without the consent of the European Union and U.S. regulators. The outcome of the latest shareholder votes clearly shows their disapproval of the company’s actions and threatens further changes if Illumina does not get to work instantly.

In response to the votes, Illumina said in a statement, “We appreciate the constructive shareholder feedback throughout this process and are committed to delivering on our plan to accelerate shareholder value creation.”

In April 2023, the U.S. Federal Trade Commission (FTC) ordered Illumina to unwind its $7 billion acquisition of cancer detective test maker Grail for antitrust concerns. In December 2022, the EU ordered Illumina to divest Grail or face a penalty of $453 million. Meanwhile, Illumina is contesting the orders of both the FTC and the EU in court.

Is Illumina a Good Stock to Buy?

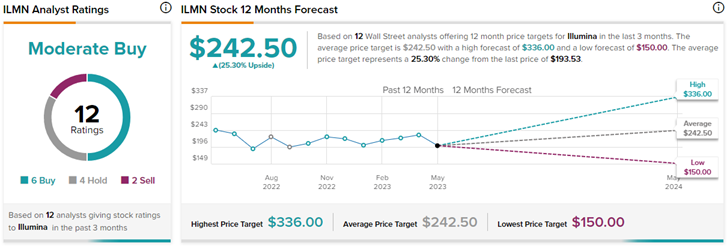

Illumina is a leader in DNA sequencing and has promising prospects. On TipRanks, the stock has a Moderate Buy consensus rating based on six Buys, four Holds, and two Sell ratings. Also, the average Illumina price target of $242.50 implies 25.3% upside potential from current levels. Meanwhile, ILMN stock has lost 3.7% so far this year.