Shares of IHS Holding (NYSE:IHS) jumped 9.9% in yesterday’s trading, followed by a 5.2% jump in after-hours trading, thanks to reports of anxious investor activism. Blackwells Capital, a private equity and investment management company, is pushing for a board overhaul at the telecom tower operator. As per the Wall Street Journal, the activist investor is sending a letter to the company’s board today, stating that a board change is necessary to turn around the company’s mounting losses and declining stock price.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

What are Blackwells’ Demands?

Blackwells has been a long-term investor and is among the ten largest shareholders of IHS. In the event that IHS’ board does not respond to the call for changes, Blackwells has threatened to initiate a proxy battle with the company. This is Blackwell’s second attempt to urge a board change, with the initial request being made in August 2022. However, the board rejected the proposal at that time. The activist investor, among various demands, is calling for IHS to change its incorporation from the Cayman Islands to a more shareholder-friendly jurisdiction within the United States.

Other large investors, including MTN, which owns a 26% stake in IHS had also demanded a shareholder meeting to discuss the company’s sale of nonvoting shares. The company states that it operates a network of roughly 40,000 telecommunications towers across Latin America, Africa, and the Middle East. Since its initial listing in October 2021, IHS stock has lost 43.7%. However, year to date, the stock is up 53%.

What is the Forecast for IHS Holding?

Based on five unanimous Buy ratings received in the past three months, IHS stock has a Strong Buy consensus rating. On TipRanks, the average IHS Holding price forecast of $17.60 implies 83.7% upside potential from current levels.

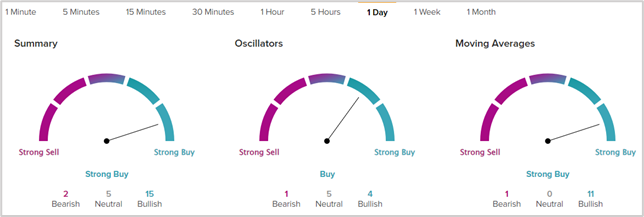

IHS technical indicators also suggest that the stock is currently a Buy. By looking at the Summary of All Indicators chart for IHS, you will see that the Oscillators display a Buy signal, while the Moving Averages present a Strong Buy signal. A combined Summary signal presents a Strong Buy view based on two Bearish, five Neutral, and 15 Bullish signals.