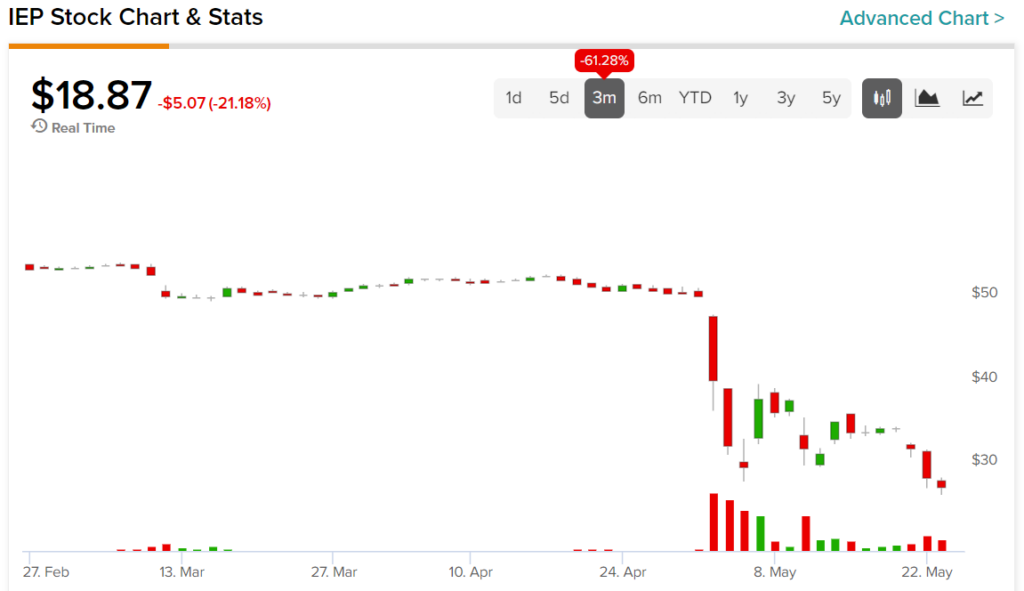

Icahn Enterprises (NASDAQ:IEP), under the leadership of billionaire Carl Icahn, has been on a rollercoaster ride, with shares plunging 21% at the time of writing, following an 11% drop earlier in the week. This ongoing nosedive follows the May 2 release of Hindenburg’s short report, leading to an overall 60% drop in Icahn Enterprise’s value. Hindenburg accused the company of overinflating its unit values and expressed concerns over margin loans.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Adding fuel to the fire, renowned hedge fund magnate Bill Ackman chimed in via Twitter, commenting on the situation despite neither being long nor short on Icahn Enterprises. According to Ackman, even after its recent plunge, IEP still trades at a hefty 50% premium to its Net Asset Value (NAV). He argued that given the company’s performance history and governance structure, a substantial discount to NAV would be more suitable.

In response to the Hindenburg report, Icahn Enterprises maintained that all personal loans involving Icahn and his affiliates are current and in full compliance. Moreover, the company revealed its strategy to repurchase up to $500 million worth of depositary units, alongside reducing short positions in its hedge book to focus mainly on activism.

A look at the past three trading months for IEP stock highlights the level of impact the short report had on it. As a result, investors are now down 61.28% during this timeframe.