It is rare for a Wall Street whale to complain of a rigged market, and when the whale in question happens to be Carl Icahn of Icahn Enterprises (NASDAQ:IEP), you know something’s cooking.

Protect Your Portfolio Against Market Uncertainty

- Discover companies with rock-solid fundamentals in TipRanks' Smart Value Newsletter.

- Receive undervalued stocks, resilient to market uncertainty, delivered straight to your inbox.

Four years ago, during the height of the COVID-19 pandemic, Icahn had wagered against the future of shopping malls. The billionaire investors had used credit default swaps (CDS) related to an index of loans from malls and other commercial properties, according to the Wall Street Journal.

The wager was that the future of malls looked bleak and the bonds may not fare well. Icahn had described the bet as “one of the best I have ever seen,” and to be fair, his CDS positions did finish the year nearly $900 million higher. Icahn, though, upped the bet from $622 million to nearly $2.1 billion in 2020.

In the aftermath of the pandemic, rising oil prices, higher interest rates, and a multitude of global geopolitical flare-ups have failed to deter stock indices and the American shopper. Consequently, Ichan’s CDS positions saw paper losses of ~$742 million last year, and have been losers this year.

The direction of the payoff from the short hinges largely on the debt of Crossgates Mall. Recently, Crossgates’ debt sold at a price just high enough to deny a payout on Icahn’s bet. The legendary investor now says the game was rigged against him.

Is IEP a Good Stock to Buy?

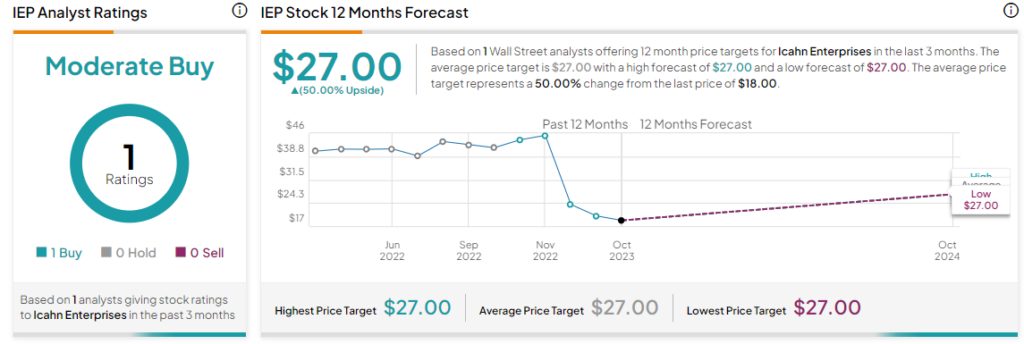

IEP shares have declined nearly 65% so far this year. Jefferies’ Daniel Fannon, the sole analyst tracking the stock, has a $27 price target on IEP alongside a Buy rating. This points to a substantial 50% upside in IEP shares.

Read full Disclosure