International Business Machines (IBM) has outlined a timeline to achieve two key milestones in quantum computing. The company now expects to show a verified quantum advantage by the end of 2026. It also plans to deliver the first large-scale, fault-tolerant quantum system by 2029.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

These goals are part of a broader strategy that includes new chips, upgraded software, and a shift to advanced chipmaking facilities. Together, these efforts reflect IBM’s push to lead in a field that may unlock faster solutions for science, finance, logistics, and more.

In the meantime, IBM shares climbed 1.48% on Tuesday to close at $313.72.

New Hardware Targets Real-World Performance

So what did the company announce? IBM introduced its most advanced processor, called Quantum Nighthawk. The chip links 120 qubits, which are the building blocks of quantum systems. These are connected with 218 improved couplers, a setup that allows more complex tasks to run while keeping error rates low.

According to the company, the Nighthawk chip can now handle circuits that are 30% more complex than those built on IBM’s last system. Users will be able to run problems that need up to 5,000 entangling operations, which are key steps in quantum calculations.

The roadmap shows this chip may scale to 15,000 operations and 1,000 or more qubits by 2028. That could help support scientific and industrial tasks that classical computers struggle with today.

IBM also introduced a second chip called Quantum Loon. This is an experimental processor designed to test the hardware needed for error correction. Reliable error correction is a requirement for building stable quantum systems that work at scale.

The Loon chip features new layers that enable qubits to communicate over longer distances on the same chip. It also supports task resets and integrates seamlessly with IBM’s software for error management.

Separately, IBM confirmed that its decoding system can now correct quantum errors in real time, within 480 nanoseconds. This step came earlier than expected and brings the company closer to its goal of fault-tolerant computing.

Fabrication Upgrades and Software Control

Beyond chips, IBM said it now produces its quantum wafers at a 300 mm facility in New York. The site uses modern semiconductor tools and has helped the company cut development time in half.

This setup also lets IBM explore more designs at once. So far, the shift has led to a tenfold jump in physical chip complexity, according to the company.

On the software side, IBM is expanding Qiskit, its quantum platform. New updates let users run dynamic circuits with better control and 24% more accuracy. A new programming interface allows high-performance computing users to build quantum tasks into their existing work. IBM also added error-handling tools that cut the cost of running accurate jobs by more than 100 times.

Outlook for Investors

IBM’s new targets offer a more specific path to revenue from quantum computing. A verified advantage in 2026 could help the company secure contracts across research, health, and defense. Its focus on hardware and software integration may also attract new enterprise users.

Long-term, fault-tolerant systems could lead to service-based models. IBM may license its hardware or software and build on its cloud offerings. The move to advanced fabrication also aligns with investor interest in next-gen chip production.

For now, IBM’s quantum unit is still in its early stages. But the clear timeline, combined with real-world progress, gives the company a lead in a sector where timelines have often remained vague.

Is IBM Stock a Buy, Hold, or Sell?

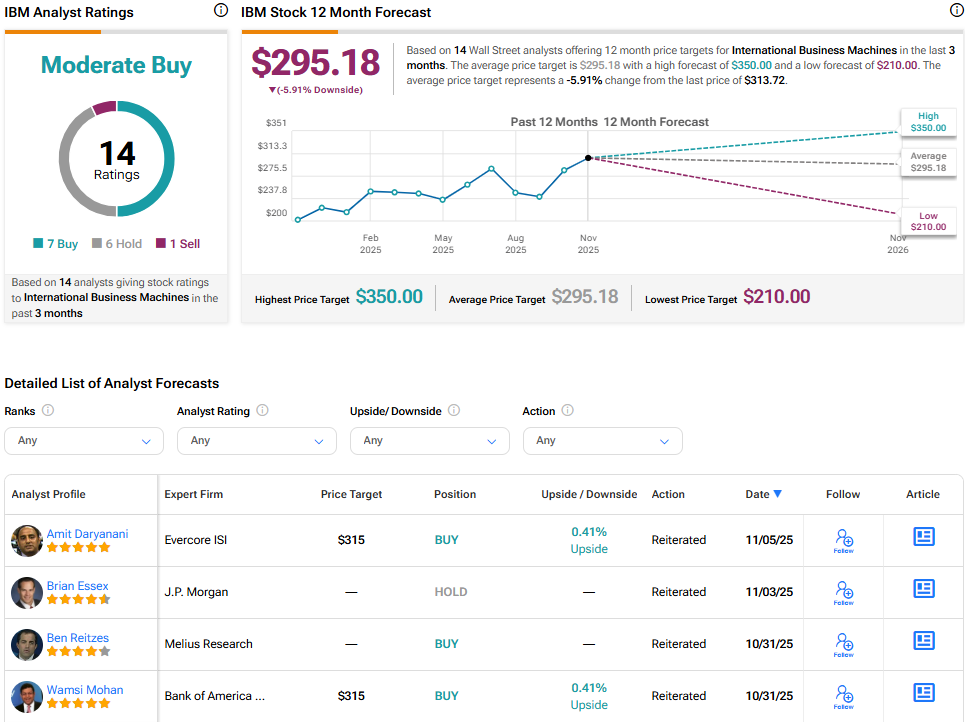

On the Street, International Business Machines boasts a relatively positive outlook with a Moderate Buy consensus. The average IBM stock price target stands at $295.18, implying a 5.91% downside from the current price.