At first mention, IBM (NYSE:IBM) seems like a footnote in the otherwise exciting technology ecosystem. While the space has benefited handsomely from artificial intelligence, IBM stock has been a notable laggard. Still, even with the sleeping giant waking up over the past few months, there may still be more growth to be extracted. I am bullish on the legacy tech juggernaut for attempting to extract true utility from AI.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

IBM Stock Often Gets Ignored in the AI Discussion

When investors think about AI, machine learning, or other related innovations, the usual suspects come up — names like Nvidia (NASDAQ:NVDA) or Super Micro Computer (NASDAQ:SMCI). It’s not just a matter of opinion. When you look at key financial metrics, it’s clear that IBM stock represents a laggard.

At the moment, NVDA trades at a trailing-year earnings multiple of 79x. For SMCI, the metric is similar (76.11x). On the other hand, IBM comes in at a multiple of only 23.4x. Typically, the argument is that Nvidia – while seemingly carrying a rich premium on paper – more than justifies it. That’s because the company appears to enjoy a clear upside pathway.

Stated differently, Nvidia can make its own market because demand for its graphics processors is so robust. Therefore, it’s difficult to pinpoint a true valuation benchmark for NVDA. However, the same courtesy is not provided for IBM stock.

Nevertheless, Wall Street may be missing the boat here. Yes, IBM stock is up 18% year-to-date. However, there could be more growth remaining. Part of the bullish thesis, of course, centers on the underlying market. According to Precedence Research, the global AI ecosystem reached a valuation of $454.12 billion in 2022. By 2032, this sector could be worth almost $2.58 billion, representing a compound annual growth rate of 19%.

It’s quite possible that “Big Blue” can grab a surprisingly large slice of the AI pie. While it doesn’t generate the headlines as other tech players, IBM commands a rich heritage in the research and development of digital intelligence. From the company’s Deep Blue program beating world chess champion Gary Kasparov in 1997 to its question-answering system Watson, IBM knows its way around AI.

Moving forward, it’s taking a bold step in achieving a potentially unprecedented level of utility in computer-generated intelligence protocols.

Big Blue Makes a Big Move

As TipRanks contributor Yulia Vaiman stated, many experts have dismissed IBM stock as a “sleeping giant.” However, Vaiman stresses that the company has been making waves with its AI-powered data platform. The most ambitious directive, though, is the tech firm’s cost-reduction initiative “through the replacement of some marketing and communications roles with [generative AI].”

Last year, IBM CEO Arvind Krishna caused a stir when he not only announced a hiring pause in May but also declared that the tech juggernaut would eventually replace nearly 8,000 jobs with AI. In particular, non-customer-facing roles may face disruption in the next five years. That may mean IBM workers in finance, accounting, human resources, and other areas may find that the machines could be gunning for their jobs.

To be fair and consistent, one of the issues I highlighted regarding digital intelligence was generative AI protocols’ high error rate. In some disciplines and under certain research cases, error rates have reached more than 80%. With such severe vulnerabilities, AI in its present form cannot be trusted.

At the same time, I also stated that whoever can crack this AI code – that is, whichever company can forward a reliable system – could win the war of the machines. For IBM stock, the underlying company can no longer pick the low-hanging fruit. That’s all gone. However, what the underlying enterprise can potentially do is deliver an AI system that could accelerate productivity while requiring minimal supervision.

Fundamentally, it’s impossible to accelerate productivity more than by just replacing human workers – workers who demand pesky stuff like salaries, restroom breaks, and civil rights – with bots and algorithms. If Big Blue can really achieve its replacement goal, it could be off to the races regarding IBM stock.

Best of Both Worlds

As an investment, there might be an argument to say that IBM stock offers the best of both worlds. In terms of capital gains, IBM is undervalued on paper. However, it might be grossly undervalued against the underlying AI fundamentals. It seems that the Street is not at all appreciating just how much market share IBM can grab.

Second, Big Blue offers a big dividend – at least as far as tech stocks are concerned. Currently, the company carries a dividend yield of 3.48%. That’s well above the tech sector’s average yield of 1.025%. And while the payout ratio is a bit on the high side at 69.05%, the company has printed dividend growth over the past 24 years.

So, while waiting for the AI narrative to pan out, you can enjoy some robust passive income.

Is IBM Stock a Buy, According to Analysts?

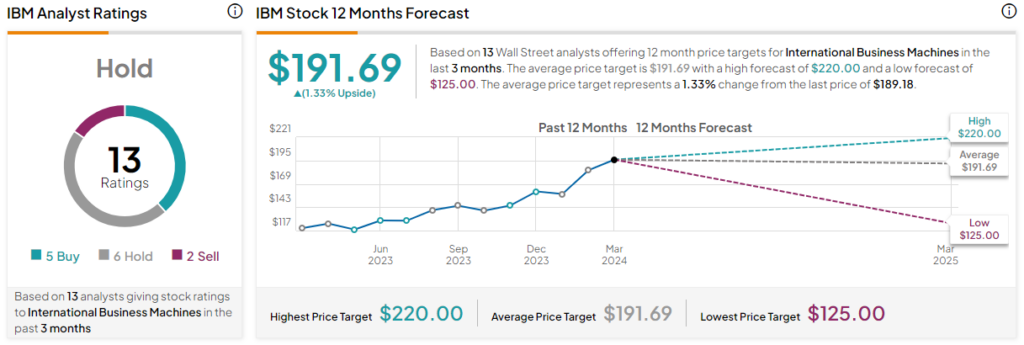

Turning to Wall Street, IBM stock has a Hold consensus rating based on five Buys, six Holds, and two Sell ratings. The average IBM stock price target is $191.69, implying 1.3% upside potential.

The Takeaway: IBM Stock Is a Hidden Gem to Watch

IBM hasn’t received much attention over the past several years. However, judging the new IBM stock based on historical trends grossly undercuts the underlying company’s potential. With the tech enterprise set to put its money where its mouth is by integrating machines into its workforce, Big Blue can accelerate AI in a way that investors really haven’t seen before.