Tech giant IBM (IBM) has released a new AI tool called the IBM Defense Model, which is designed specifically for defense and national security use. The model was developed in partnership with Janes, a company known for providing reliable, open-source defense intelligence. Unlike general-purpose AI systems, this one is built to handle defense tasks and can be safely deployed in high-security settings, such as classified and remote environments.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Notably, this new model runs on IBM’s Granite foundation models and is available through the watsonx.ai platform. It supports tasks like mission planning, reporting, document analysis, and military simulations. The model has also been trained on military-specific data, so it understands defense terminology and can interpret real-time intelligence like a human analyst would. IBM says that this reduces errors known as AI “hallucinations” by focusing on live, reliable data rather than on static information.

In addition, the model meets ISO 42001 standards for AI governance and can operate in highly secure environments. It also receives regular updates from Janes to keep its information current. As a result, IBM and Janes claim that this tool will help defense agencies make faster, more informed decisions without compromising security or accuracy.

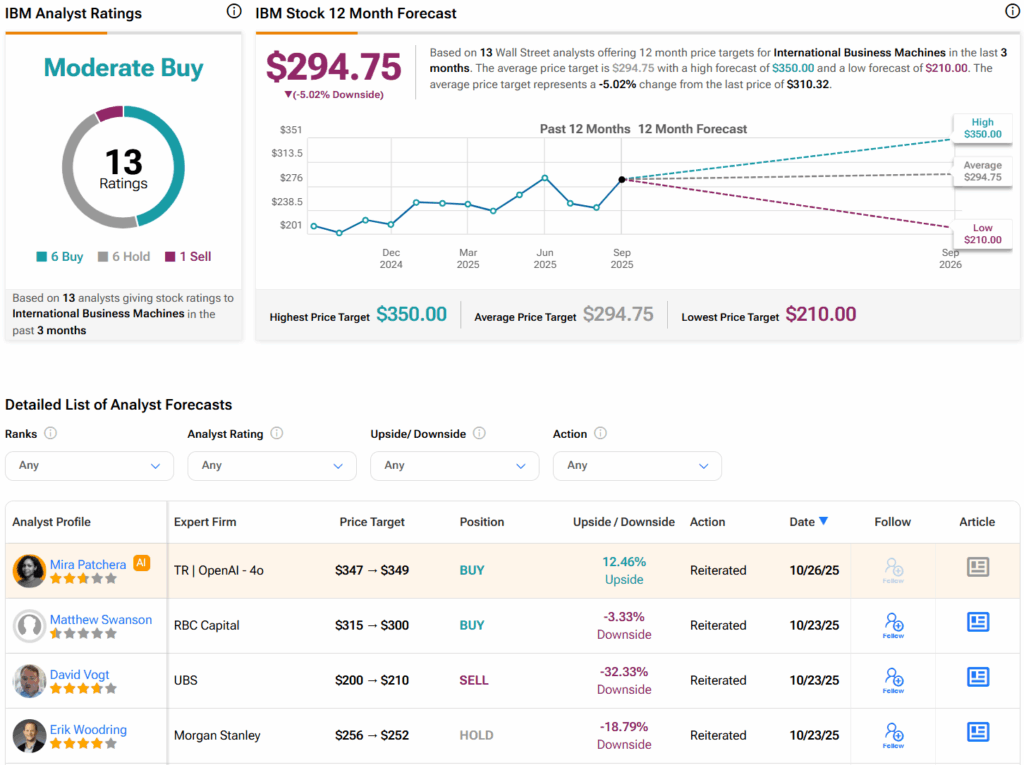

Is IBM a Buy, Sell, or Hold?

Turning to Wall Street, analysts have a Moderate Buy consensus rating on IBM stock based on six Buys, six Holds, and one Sell assigned in the past three months, as indicated by the graphic below. Furthermore, the average IBM price target of $294.75 per share implies 5% downside risk.