Tech giant IBM (NYSE:IBM) and cybersecurity company Palo Alto Networks (NASDAQ:PANW) have announced a strategic partnership to jointly develop and sell artificial intelligence (AI)-powered security products. The partnership will enable the companies to deliver AI-powered security solutions that address the growing demands of digital transformation.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

As part of this deal, PANW will acquire IBM’s QRadar Software as a Service (SaaS) assets, including the associated intellectual property rights. The divestiture of the QRadar software is intended to streamline IBM’s product suite and eliminate overlaps with Palo Alto Networks’ offerings.

Under the terms of the agreement, IBM’s on-premise (on-prem) QRadar clients who wish to remain on QRadar on-prem will continue to receive IBM features and support. On the other hand, clients opting to migrate to Cortex XSIAM will receive no-cost migration services.

Strategic Rationale Behind the Partnership

The financial terms of the deal were not disclosed. However, this partnership presents significant opportunities for both companies and will help them capitalize on fast-growing markets such as digital transformation and AI.

A Wall Street Journal report highlighted that IBM CEO Arvind Krishna expects the deal to contribute several hundred million dollars to the company’s revenue over the next three to five years. This is because IBM will receive incremental payments from Palo Alto Networks for QRadar on-prem clients who will migrate to the Cortex XSIAM platform.

Moreover, Palo Alto Networks will integrate its cybersecurity solutions into IBM’s Consulting Advantage AI services platform. This collaboration allows Palo Alto Networks to leverage IBM’s watsonx AI platform and is expected to bolster Palo Alto Networks’ security portfolio.

With this backdrop, let’s look at the Street’s forecast for IBM and PANW stocks.

Is IBM a Buy, Sell, or Hold?

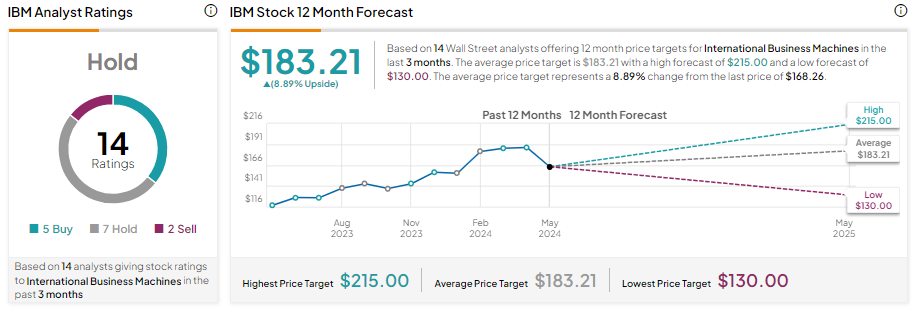

IBM stock gained over 42% in one year as it is pivoting towards a hybrid cloud and AI-focused business model. However, Wall Street analysts are sidelined on IBM stock.

It has five Buys, seven Holds, and two Sell recommendations for a Hold consensus rating. Analysts’ average price target on IBM stock is $183.21, implying 8.89% upside potential from current levels.

Is PANW a Buy or Sell?

PANW stock is up over 63% in one year. The stock sports a Moderate Buy consensus rating based on 29 Buys and 10 Hold recommendations. Analysts’ average price target on PANW stock is $334.16, implying 6.99% upside potential from current levels.