Tech giant IBM (IBM) and asset manager Vanguard have teamed up to explore how quantum computing could help build better investment portfolios. Indeed, traditional models like the Markowitz model try to balance risk and return but rely on unrealistic assumptions, such as perfect knowledge of returns and no real-world limitations like transaction costs or regulations. In contrast, real portfolio construction is much more complex and includes many practical constraints.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

To address this, the researchers used a new method that combines quantum computing with classical techniques. This hybrid approach, known as a variational quantum algorithm (VQA), could make it easier to find good solutions. In fact, as the number of assets in a portfolio increases into the thousands, and more rules are added, the math becomes extremely difficult, and classical computers can struggle to solve these problems efficiently.

However, quantum algorithms like VQAs use short, simple quantum circuits to search for promising answers, which are then improved through classical optimization methods. Because they don’t require perfect quantum hardware, VQAs can already run on today’s machines. Interestingly, this approach outperformed classical methods alone, especially as the problems got harder. As a result, combining quantum and classical tools could help financial professionals make better decisions in the future.

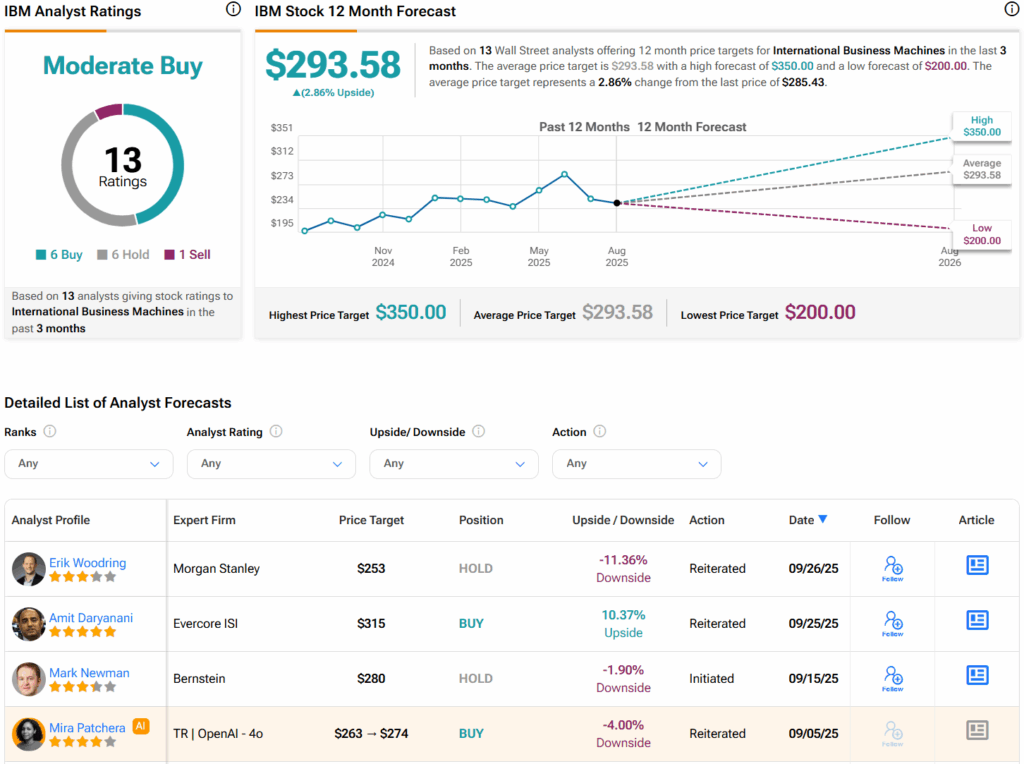

Is IBM a Buy, Sell, or Hold?

Turning to Wall Street, analysts have a Moderate Buy consensus rating on IBM stock based on six Buys, six Holds, and one Sell assigned in the past three months, as indicated by the graphic below. Furthermore, the average IBM price target of $293.58 per share implies 2.9% upside potential.