Interactive Brokers (IBKR), a brokerage and online trading platform, has posted strong third-quarter financial results driven by a flurry of trading activity with stock markets near all-time highs.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

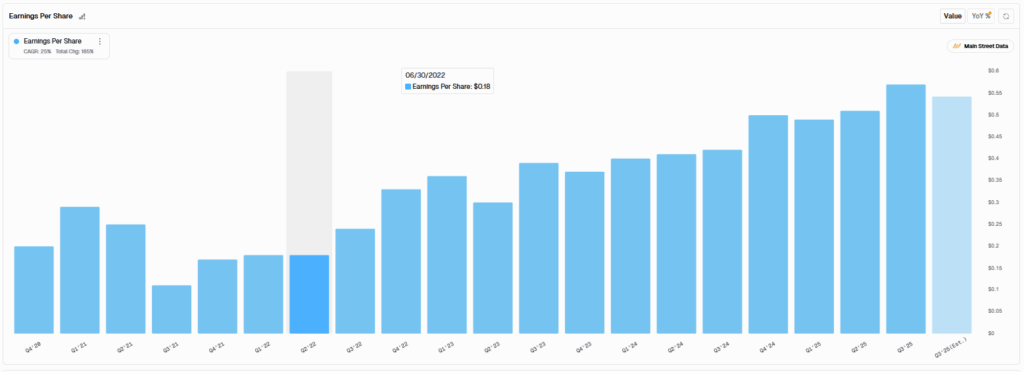

The Greenwich, Connecticut-based company reported earnings per share (EPS) of $0.57, beating Wall Street forecasts that called for a profit of $0.54. Revenue in the period came in at $1.66 billion, which topped the consensus estimate of $1.52 billion.

In the same period a year ago, Interactive Brokers announced earnings of $0.42 a share on revenue of $1.40 billion. Management attributed the strong showing to higher trading volumes during the quarter as the stock market rally led investors to open more accounts and use more margin, or debt, to buy equities.

Interactive Brokers’ earnings per share. Source: Main Street Data

Trading Volumes

The company said that customer trading volumes in stocks and options increased 67% and 27%, respectively. Total customer accounts rose 32% year-over-year in Q3 to 4.13 million. Daily average revenue trades, a brokerage industry metric, jumped 34% to 3.62 million. And margin loans soared 39% to $77.3 billion.

Interactive Brokers has been focused on attracting more individual or retail investors. The company introduced a new desktop trading platform earlier this year and has been adding features such as an artificial intelligence (AI) assistant designed to appeal to individual as well as institutional clients.

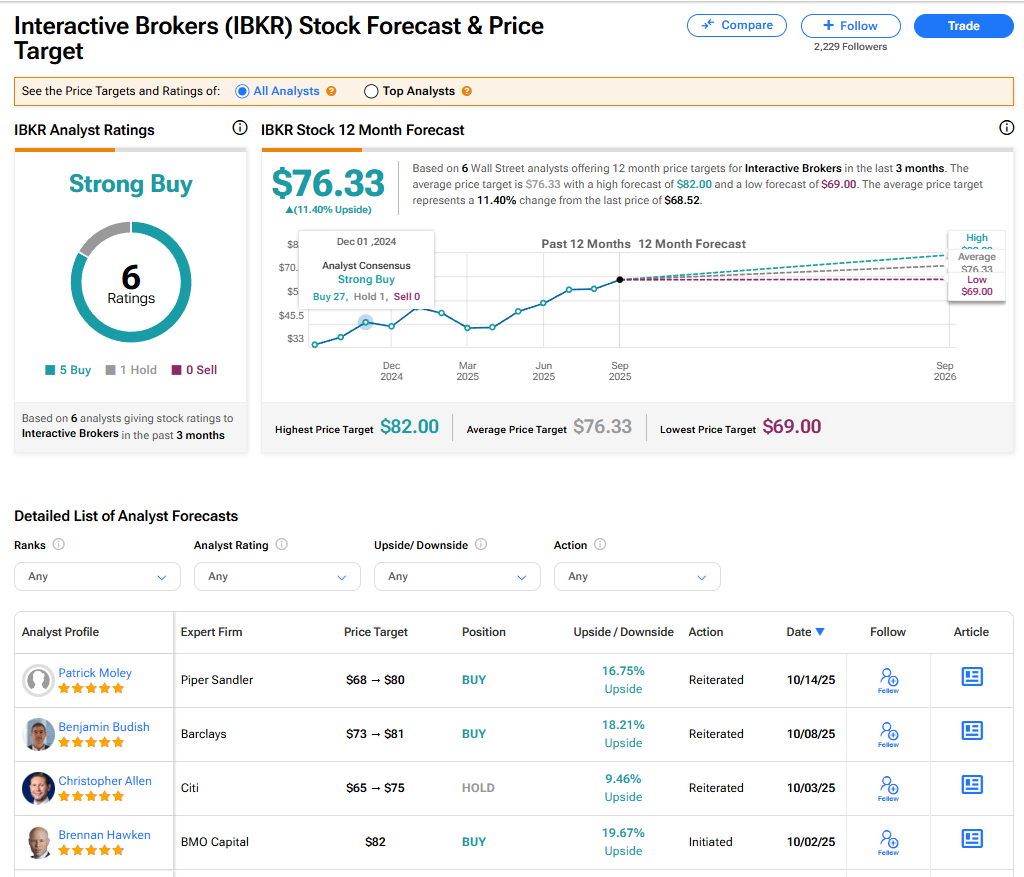

Is IBKR Stock a Buy?

The stock of Interactive Brokers has a consensus Strong Buy rating among six Wall Street analysts. That rating is based on five Buy and one Hold recommendations issued in the last three months. The average IBKR price target of $76.33 implies 11.40% upside from current levels. These ratings are likely to change after the company’s financial results.