iA Financial (TSE: IAG) is a life and health insurance company. It offers life and health insurance products, savings and retirement plans, mutual funds, securities, auto and home insurance, mortgages, and more.

The company announced that it will issue C$250 million worth of new debt at an interest rate of 6.611%, which will mature in 2082. In addition, the interest rate will reset every five years at an interest equal to the prevailing five-year Government of Canada Yield at the date of reset, plus 4%.

This reset feature can be either good or bad for iA Financial. If we are in a low inflationary environment at the date of reset, then it’s likely that the interest rate will decrease, which would lower the company’s expenses. The opposite is true if we find ourselves in a situation similar to today where inflation is running hot, and Government bond yields trend higher.

The company plans to use the funds from this offering for general corporate purposes such as investments in subsidiaries and the repayment of existing debt.

Insider Activity

iA Financial’s stock price has fallen roughly 10% year-to-date, as equities have had a rough start to 2022. However, it is encouraging to see that more insiders have been buying the stock than selling it in the past several days.

As you can see from the image above, the insider confidence signal for iA Financial is very positive and is even higher than the sector average. The most interesting transactions came from François Blais and Pierre Miron, who increased their holdings in the company by almost 21% and 45%, respectively.

Analyst Recommendations

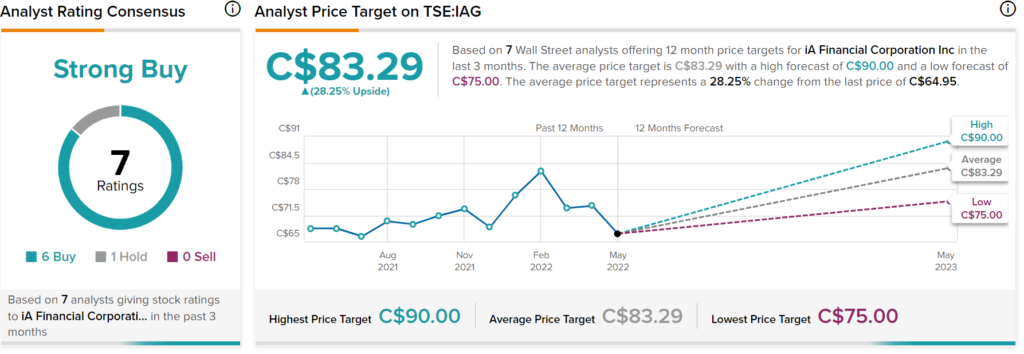

iA Financial has a Strong Buy consensus rating based on six Buys and one Hold assigned in the past three months. The average iA Financial price target of C$83.29 implies 28.3% upside potential.

Analyst price targets range from a low of C$75 per share to a high of C$90 per share.

Final Thoughts

After a rough start to the year, it appears that both insiders and analysts feel confident that the company will see strong performance going forward. Investors may want to consider taking a deeper look into iA Financial to see if it meets their investment criteria.

Read full Disclosure