Shares of Bitcoin miner Hut 8 (HUT) are soaring today as the euphoria of Trump’s presidential victory sweeps across the crypto industry. Nevertheless, that was not the only piece of good news for Hut 8. Indeed, the firm recently released its operational update for October 2024, where it announced plans to boost its mining capacity with the purchase of 31,145 Antminer S21+ units at $15 per terahash.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

CEO Asher Genoot highlighted that the S21+ units offer a quicker payback than other models, which could potentially improve returns. This upgrade will add 3.7 exahashes per second (the number of calculations a miner can perform per second) and increase Hut 8’s self-mining power by 66% to reach around 9.3 EH/s.

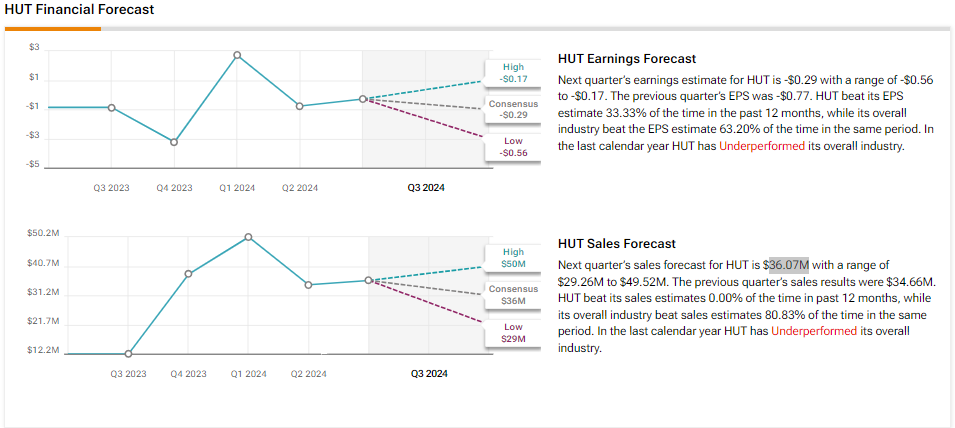

Furthermore, in October 2024, Hut 8 had a total hashrate under management of 20.1 EH/s, up from 19.5 EH/s in September, with 194,200 miners deployed. The firm produced 100 Bitcoins (BTC-USD) in October, compared to 85 in September, and had 9,110 BTC on its balance sheet by the end of the month. The firm is also expected to report its Q3 earnings results on November 13 before the market opens. Analysts estimate that EPS will come in at -$0.29 on revenue of $36.07 million.

Is Hut a Good Stock to Buy?

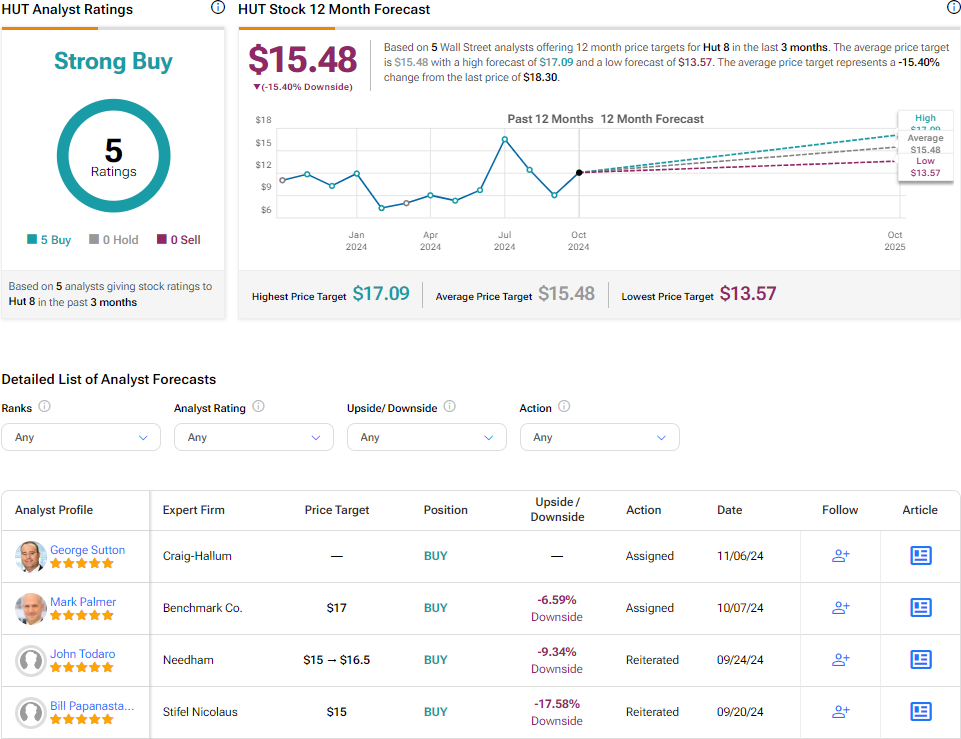

Overall, analysts have a Strong Buy consensus rating on HUT stock based on five Buys assigned in the past three months, as indicated by the graphic below. However, after a 54% increase in its share price over the past year, the average HUT price target of $15.48 per share implies 15.4% downside risk.