For biotech stocks like Humacyte (NASDAQ:HUMA), there are three major factors that give that stock extra life in the market: successful drug tests, new funding, and analyst approval. Today, Humacyte proved as much nicely with a new upgrade that sent shares rocketing up over 19% in Monday afternoon’s trading.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Piper Sandler analysts upgraded Humacyte from “underweight” to “neutral”, largely because of Humacyte’s second quarter financial report. The news wasn’t all that great, as Humacyte posted a loss of $0.22 per share, and cash and cash equivalents on hand of $114.6 million, giving it a decent cash runway while it works on drug development. Piper Sandler analysts didn’t seem especially concerned about this, though, citing a set of “near-term catalysts” that point to better in the future. Further, the loss isn’t all that surprising, Piper Sandler noted, in light of the “ongoing clinical programs” currently at work.

The biggest selling point for Humacyte in the future, Piper Sandler noted, is the Human Acellular Vessel (HAV), which is designed for use in vascular repair. It’s basically an implantable chunk of vascular conduit, which has already been shown to work in testing in Ukraine. Humacyte was using its HAV units to treat combat injuries, which certainly suggests it can do a good job on most any other kind of injury as well. In fact, results from the Ukrainian testing suggested that, of the 19 traumatic injury patients treated, 95% had blood flow in the treated area after just 30 days. Not one of the patients saw infection, either.

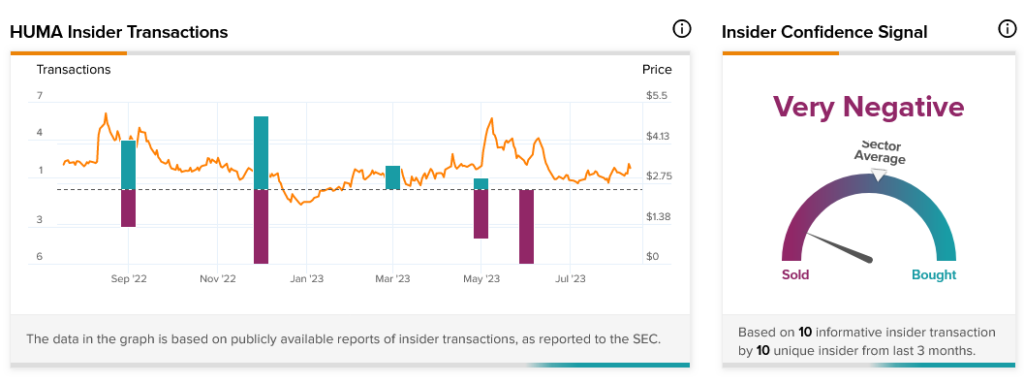

Despite these impressive results, insider trading figures at Humacyte suggest that insiders aren’t looking for much in the way of results. In fact, insider confidence is currently considered “Very Negative,” as insiders sold a combined total of $64.3 million worth of Humacyte shares in the last three months alone.