While legacy automaker Ford (F) has pared back somewhat on its electric vehicle ambitions, that does not mean it is out of the market altogether. Rather, it is reconsidering the field and figuring out how best to compete . Recent word about improvements in the Mustang Mach-E demonstrates as much.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

One of the biggest differences, noted a report from Car & Driver, is the price. In a novel twist, the price on something actually went down, going from $41,990 to $38,490 for a starting price. Which is still pretty expensive by most measures, but a price cut is a price cut.

The new Mach-E includes a heat pump, which will help improve power usage rates in cold-weather operations. And, when you throw in some cosmetic upgrades as well as the latest version of Ford’s Blue Cruise driver assist technology, a good deal only gets better.

Supplier Shift Ahead?

In other news, a supplier change might impact Ford down the line, as Dana—a longtime Ford supplier—considers selling off its off-highway operations. The report from Automotive News detailed how Dana might make such a sale as a response to “…sluggish demand in its key markets.”

Reports suggest that the unit could be valuable, pulling in “…a few billion dollars…” when sold, but the reports also hastened to mention that any deal that would result in such a sale is still in “a very early stage.”

Is Ford Stock a Good Buy?

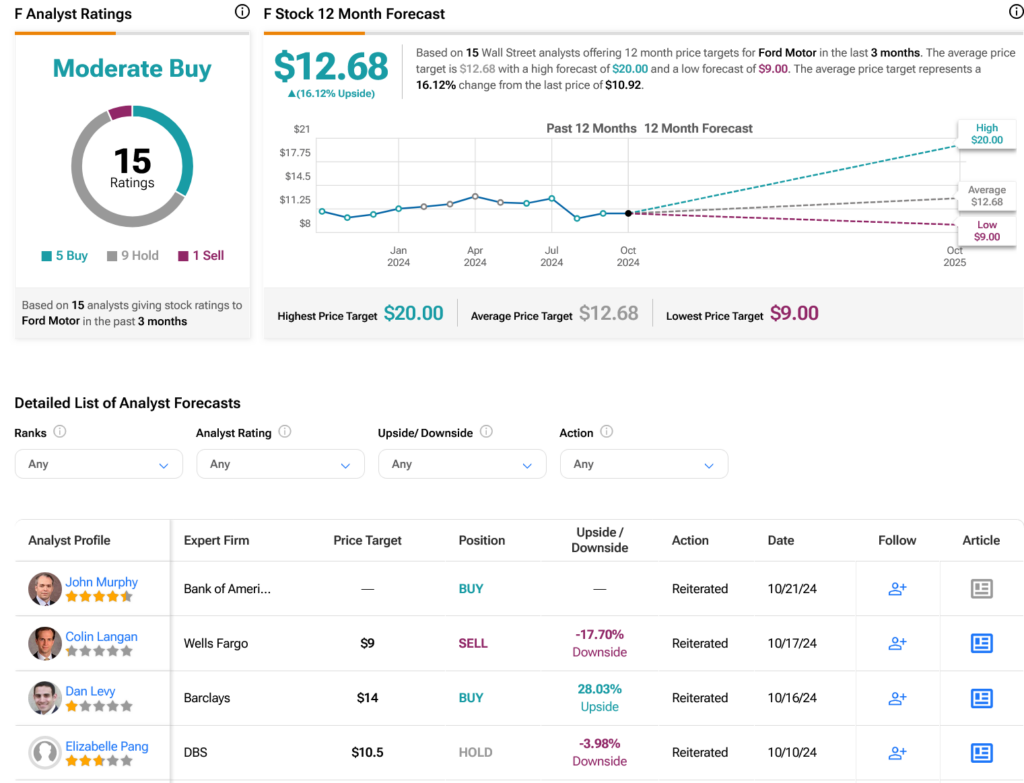

Turning to Wall Street, analysts have a Moderate Buy consensus rating on F stock based on five Buys, nine Holds and one Sell assigned in the past three months, as indicated by the graphic below. After a 2.1% rally in its share price over the past year, the average F price target of $12.68 per share implies 16.12% upside potential.