Insiders can sell stocks for a lot of reasons. But insiders tend to buy stocks for one reason: they think the value is about to go up. At HighPeak Energy (NASDAQ:HPK), that’s just what happened. Insider investors bought in big on this oil stock, and the share price shot up accordingly, passing 14% at one point in Monday afternoon’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

A Securities and Exchange Commission filing from John Paul Dejoria, who owned 11% of the stock ahead of the filing, revealed that he had picked up a ton of new shares, buying another 6.57 million shares valued at $10.50 each. That was the biggest purchase that anyone made in the preceding 12 months. What’s more, he wasn’t alone. Another six insiders picked up stock, including two other eight-figure purchases.

The measure comes at an interesting time for HighPeak Energy; it, just earlier today, declared a cash dividend of $0.025 per share. That was in line with previous dividends, but the insider purchases were all made significantly ahead of today’s dividend announcement. Even more interesting, only days ago, HighPeak Energy shares plunged following a plan to sell more shares of stock.

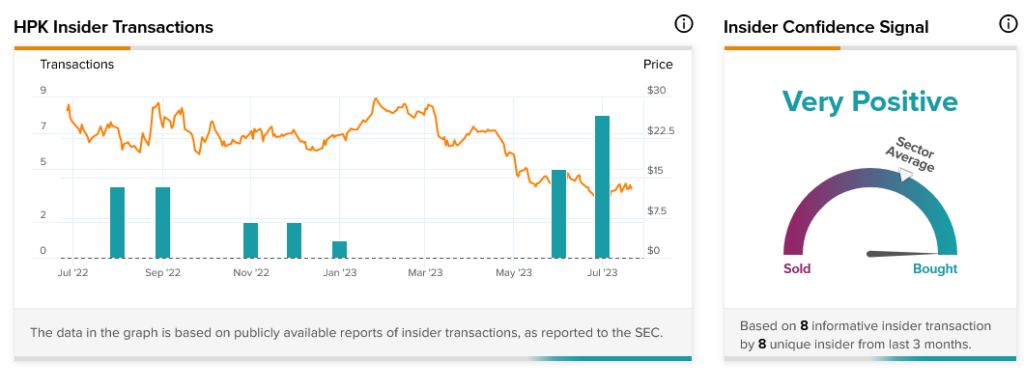

Keeping all this in mind, it will prove no surprise that insider sentiment is currently considered “Very Positive.” In fact, just in the last three months, insider trading at HighPeak Energy has been explosive, with insiders buying up $93 million worth of shares. The absolutely staggering part is that these purchases are some of the first insider purchases made in months. The last purchase before the major run-up was made back in December 2022. Then, there was nothing until May, followed by June’s purchases.