Banking giant HSBC (NYSE:HSBC)(GB:HSBA) delivered stellar Q1 earnings, led by higher global interest rates. The financial services giant posted a PAT (Profit after Tax) of approximately $11 billion, reflecting a more than three-fold jump from the prior year’s quarter.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

At the same time, HSBC delivered revenues of $20.2 billion, up 64% year-over-year.

Higher net interest income (NII) due to interest rate hikes and tight cost discipline drove Q1 revenue and profit. Meanwhile, the $2.1 billion reversal of an impairment relating to its planned sale of retail banking operations in France (as the transaction becomes less certain) and a provisional gain of $1.5 billion from its acquisition of Silicon Valley Bank UK in March supported its financials.

HSBC’s NII increased to approximately $9 billion compared to $6.5 billion in the prior year period. Further, non-interest income came in at about $11.2 billion.

Management reiterated its NII outlook and expects to generate at least $36 billion in 2023, compared to $32.5 billion reported in 2022. Furthermore, the firm announced a Q1 dividend of $0.10 a share and a $2 billion share buyback plan.

HSBC’s management remains upbeat and expects the momentum in its business to sustain. Moreover, the firm benefits from the transformation plan announced in February 2020 to achieve higher returns via the efficient use of capital. Also, under the program, HSBC exited non-strategic assets and loss-making businesses.

What’s the Prediction for HSBC Stock?

A higher interest rate environment, a focus on cost savings, and investments to bolster its Wealth division will likely support its revenue and cushion profit. However, the uncertain global economic trajectory could pose challenges.

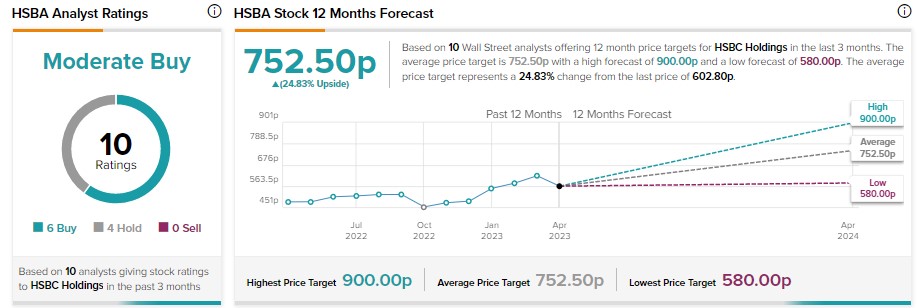

HSBC stock has received six Buy and four Hold recommendations, translating into a Moderate Buy consensus rating. Analysts’ average price target of 752.50p implies 24.83% upside potential.