HP (NYSE:HPQ), at the Securities Analyst Meeting, unveiled 2024 guidance, which indicates that its EPS will register year-over-year growth. At the same time, the manufacturer of personal computing and printing products raised its annual dividend. Let’s delve deeper.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

HP’s Fiscal 2024 Outlook

HP’s leadership said that the company will deliver adjusted earnings in the range of $3.25 to $3.65 per share in Fiscal 2024. This compares favorably to its EPS guidance of $3.23 to $3.35 for Fiscal 2023. The year-over-year improvement in EPS reflects the company’s focus on improving its cost structure. Further, a recovery in demand and share buybacks will cushion its bottom line.

The company increased its annual dividend by 5% to $1.10 per share thanks to its improved cost structure and expanding earnings base. This translates into a forward yield of over 4.2% based on its closing price of $26.43 on October 10. Further, the company expects to return all of its Fiscal 2024 free cash flows to its shareholders through dividends and share repurchases.

Highlighting HP’s dividend growth, HP’s CFO, Marie Myers, said that the company’s focus on accelerating its cost savings and growing its EPS and free cash flows will enable it to “maximize growth” and create more value for its shareholders.

Furthermore, HPQ reiterated its full-year sales and earnings outlook. The company sees 2-4% growth in its top line in the long term. Meanwhile, its adjusted EPS is anticipated to grow at a high single-digit rate.

As HP expects its EPS to improve and plans to enhance shareholders’ returns, let’s look at what analysts recommend for its stock.

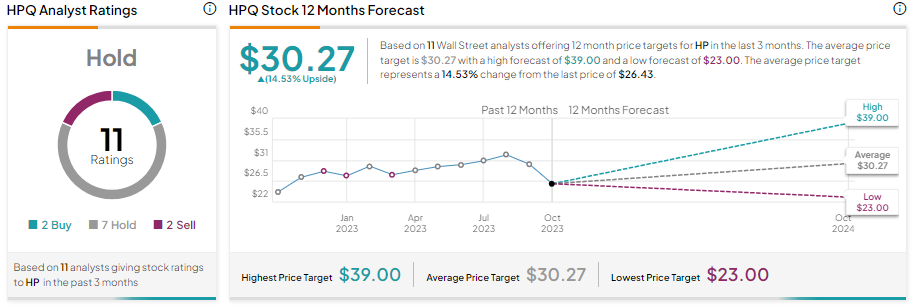

Is HPQ a Buy or Sell?

Following the Securities Analyst Meeting, Goldman Sachs analyst Mike Ng increased his EPS estimates for HPQ. The analyst expects HP and the PC market to benefit from the replacement cycle, AI (artificial intelligence), Windows OS refresh, and hybrid work. However, the analyst reiterated a Hold recommendation on HPQ stock due to the challenges in the Printing segment and near-term pricing headwinds.

Overall, HPQ stock has received two Buy, seven Hold, and two Sell recommendations for a Hold consensus rating. Meanwhile, analysts’ average price target of $30.27 implies 14.53% upside potential in HP stock from current levels.