Shares of Hewlett Packard Enterprise (NYSE:HPE) declined about 8% in yesterday’s extended trading session following mixed results for the second quarter of 2023. The company witnessed strong demand for its AI offerings in the quarter and said it received orders worth over $800 million from large cloud providers and enterprise customers.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

HPE posted adjusted earnings of $0.52 per share, up 68% compared to the prior-year quarter, and surpassed the analysts’ estimates of $0.49 per share. Meanwhile, net revenue rose 4% year-over-year to $7 billion but was marginally lower than analyst estimates of $7.3 billion.

In the second quarter, the company witnessed a 50% growth in revenues from the Intelligent Edge segment and an 18% jump in the High-Performance Computing & Artificial Intelligence unit’s revenue. However, Compute unit revenue fell by 8% year-over-year.

Moving on, the company’s annualized revenue run-rate (ARR) grew 35% to $1.1 billion, while total as-a-Service orders dropped 8%.

Based on strong demand and continued business momentum, HPE expects Q3 FY23 adjusted earnings to fall in the range of $0.44 to $0.48 per share. Meanwhile, revenues are anticipated to be between $6.7 billion and $7.2 billion.

For Fiscal Year 2023, the company raised the guidance range for adjusted earnings to $2.06 and $2.14, compared with the prior outlook of $2.02 and $2.10. Lastly, revenue growth is expected to be in the range of 4%-6%.

Is HPE Stock a Good Buy?

HPE has been making efforts to strengthen its AI and 5G offerings by undertaking strategic acquisitions. Furthermore, solid momentum in its annualized recurring revenue and decent capital deployment activities are encouraging.

Following the Q2 earnings release, analyst Mike Ng from Goldman Sachs reiterated a Hold rating on HPE stock. The analyst is optimistic about HPE’s networking investments and the introduction of new consumption models through Greenlake. At the same time, he believes HPE’s growth might be impacted by “industry headwinds in servers from the shift of workloads to the cloud & lower commodity costs.”

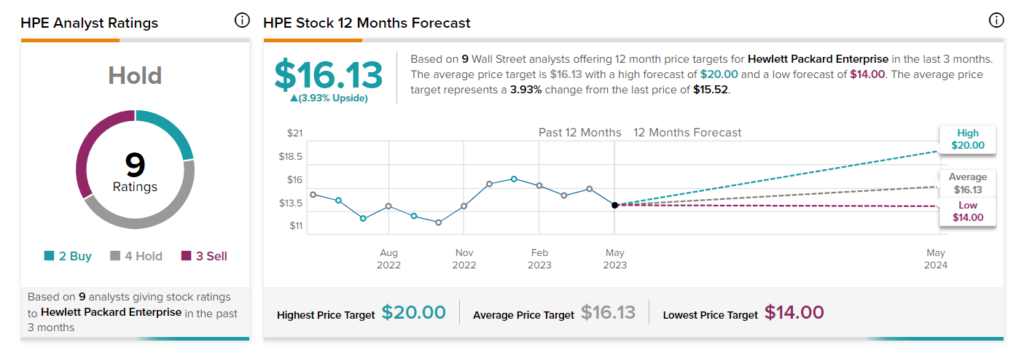

Overall, the stock has a Hold consensus rating based on two Buys, four Holds, and three Sells. The average HPE stock price target of $16.13 implies 3.9% upside potential to current levels. The stock is down 2.5% in 2023 so far.