Hewlett Packard Inc. bumped up its cash dividend by 10% after the computing giant posted better-than-expected quarterly results, as the pandemic-led work-from-home trend spurred demand for its PCs. Shares jumped 5.5% in Tuesday’s extended market trading.

HP Inc. (HPQ), which focuses on PCs and printers, declared a cash dividend of 19.38 cents per share, its first in fiscal year 2021. This translates into an annualized dividend of 78 cents and a dividend yield of about 3.56%The dividend is payable on January 6, 2021, to stockholders of record as of the close of business on Dec. 9, 2020. HP has about 1.3 billion shares of common stock outstanding.

The move comes after the PC maker reported a 1% decline in its fiscal fourth-quarter sales to $15.3 billion from the year-ago period, which however outpaced the $14.7 billion forecasted by analysts. On a business segment comparison, consumer net revenue increased 24% year-on-year, while business sales fell 12% during the same period. The number of total units were up 7%, with notebooks units climbing 25%. HP posted a 21% increase in consumer hardware sales and a 22% decline in hardware revenue from businesses.

In the three months ended Oct. 31, HP earned an adjusted 62 cents a share, exceeding analysts’ expectations of 52 cents. For the current quarter, adjusted profit is projected to be between 64 cents to 70 cents a share, compared to the 54 cents estimated by the Street consensus.

“We had record unit shipments in the quarter, reflecting the important role HP technology is playing in the lives of our customers. Our results give us great confidence in our ability to drive long-term growth and shareholder value in 2021 and beyond,” commented HP CEO Enrique Lores. “People need [a PC] for working, for learning, for gaming, for entertaining, for communicating, and the trend that we see is for every person to have their own PC. This is really driving significant demand on the PC side.”

In the fourth quarter, HP returned $1.6 billion to shareholders through share repurchases and dividends. The company used $1.34 billion of cash during the quarter to repurchase approximately 71 million shares of common stock in the open market and paid a cash dividend of $238 million. As a result, HP returned 88% of its fourth quarter free cash flow to shareholders.

HP exited the quarter with $5.1 billion in gross cash, which includes cash and cash equivalents and short-term investments of $0.3 billion included in other current assets.

Shares in HPQ have surged 19% over the past month and are now up almost 6% since the start of the year. (See HPQ stock analysis on TipRanks).

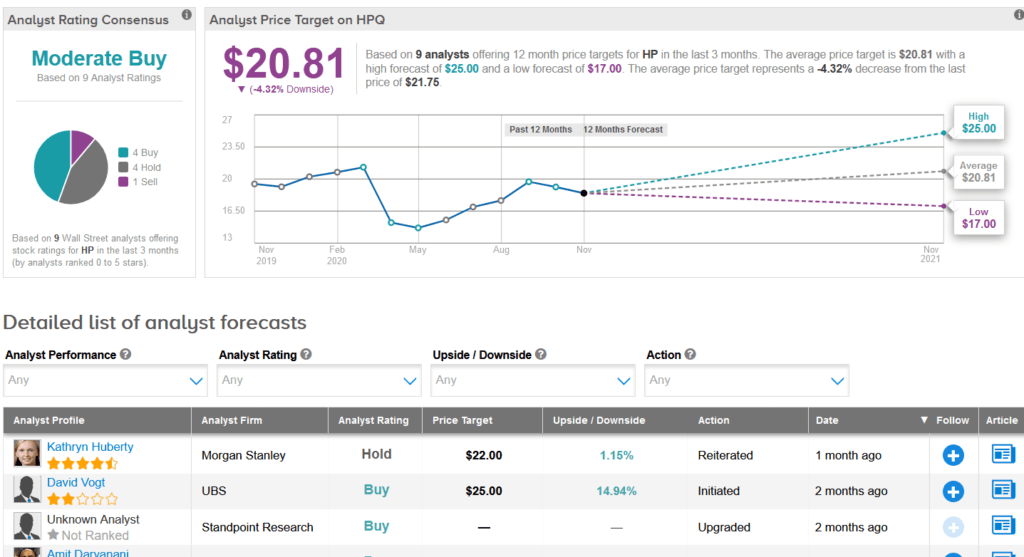

Overall, the rest of the Street has a cautiously optimistic outlook on HP. The Moderate Buy analyst consensus breaks down into 4 Buys, 4 Holds, and 1 Sell. The average price target stands at $20.81 and implies potential downside of 4.3% over the coming 12 months.

Related News:

Ambarella Spikes 9% On 3Q Beat, Upbeat Sales Outlook

Snap Rolls Out TikTok-Style Short Video Feature; Stifel Is Bullish

GSX Techedu Sinks 8% On Wider-Than-Feared 3Q Loss; Stock Up 200% YTD