Video game stocks are a hot topic today after a new report from The Motley Fool revealed that the U.S. market has suffered stagnation over the last few years. $59.3 billion in sales were reported for the U.S. gaming industry in 2019, which is an impressive number that outperforms the film, music, and book publishing industries combined. However, there’s a concern about stagnation when comparing 2019 sales with results from the following five years.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Here’s a quick breakdown of U.S. video game industry revenue over the last six years:

- $59.3 billion reported in 2019.

- $57.7 billion reported in 2020.

- $61.2 billion reported in 2021.

- $57.4 billion reported in 2022.

- $59.5 billion reported in 2023.

- $59.3 billion reported in 2024.

This shows a clear case of stagnation, as AAA game studios have experienced rising development costs and difficulty attracting consumers. Part of this comes from pushback over current game design philosophies and messages, as the culture war continues to remain front and center in the game industry. Additionally, poor optimization, monetization of games, and other issues have left a black mark on the AAA game market.

Video Game Stock Movements Today

While the stagnation report for the game industry isn’t good news, other happenings today have investors excited. That includes Electronic Arts’ (EA) new deal to go private. This has the company’s shares up 4.65% on Monday. Take-Two (TTWO) stock also gained 1.25%, Nintendo (NTDOF) stock climbed 1.13%, and Microsoft (MSFT) saw a slight boost to its share price. However, Sony (SONY) stock was down 2.37% today.

Video Game Stock Comparisons

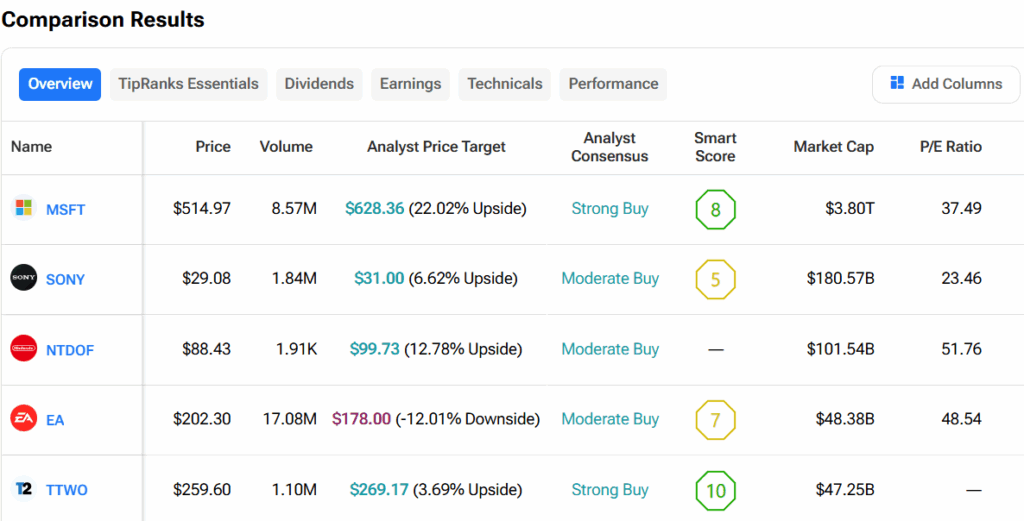

Turning to the TipRanks stock comparison tool, traders can see which video game stocks analysts favor. Microsoft and Take-Two both have consensus Strong Buy ratings, while Sony, Nintendo, and EA have Moderate Buy ratings. MSFT has the highest upside potential at 22.02%, followed by NTDOF at 12.78%, SONY at 6.62%, and TTWO at 3.69%.