Lila Sciences, a startup founded in 2023, has raised $115 million in new funding from investors, including chipmaker Nvidia’s (NVDA) venture arm, to create “scientific superintelligence.” According to Reuters, this brings its Series A total to $350 million and its overall funding to $550 million. With the new capital, Lila’s valuation has climbed above $1.3 billion, which shows that investor interest in using AI to make scientific breakthroughs is strong. Interestingly, Lila’s main goal is to speed up scientific discovery by combining custom AI models with fully automated labs, which it calls “AI Science Factories.”

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

These facilities use robotic tools that are controlled by AI to run experiments around the clock. The fresh funding will help Lila expand these operations. In fact, it recently leased a 235,500-square-foot facility in Cambridge, Massachusetts, which was one of the region’s largest lab leases this year. Lila also plans to let outside companies use its platform through enterprise software. And while it didn’t provide specific names, the company stated that there has been interest from firms in the energy, semiconductor, and drug development sectors.

Notably, unlike many AI labs that rely on internet data, which some experts believe is nearly exhausted, Lila focuses on creating new data through experiments. The company believes that success in AI for science will depend on having the most advanced automated labs, not just big data centers. In addition, the company claims to have already made thousands of discoveries in life sciences, chemistry, and materials. However, Lila doesn’t plan to bring new molecules or energy technologies to market itself, but expects its partners and platform users to do so.

What Is a Good Price for NVDA?

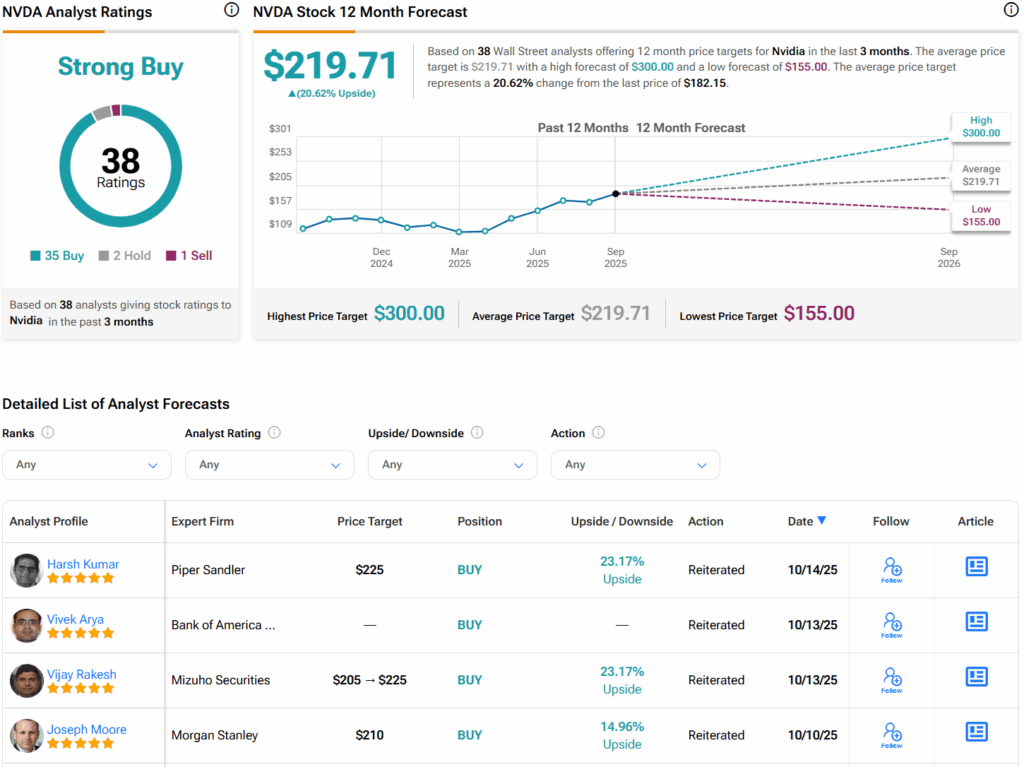

Turning to Wall Street, analysts have a Strong Buy consensus rating on NVDA stock based on 35 Buys, two Holds, and one Sell assigned in the past three months, as indicated by the graphic below. Furthermore, the average NVDA price target of $219.71 per share implies 20.6% upside potential.