Oracle (ORCL) came in swinging in the cloud arena, shifting from a sleepy position among hyperscalers to suddenly trying to claim relevance within the leading pack. A few massive deals in the quarter reported last September shocked the market, sending backlog commitments to stratospheric levels and instantly putting Oracle at the top of the hyperscaler group in terms of RPO (remaining performance obligations).

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

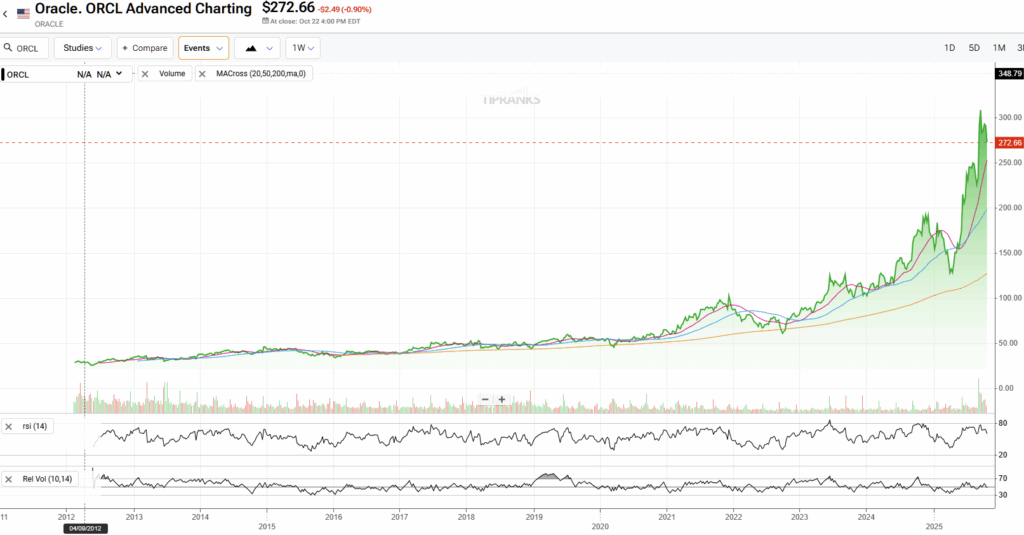

The stock reacted with a sharp re-rating that month, as analysts revised both top- and bottom-line forecasts meaningfully upward. The rally that followed has been remarkable—and somewhat unusual for a software company that had been treading a flat growth path for years.

Still, a fat backlog doesn’t automatically translate into immediate value creation. There are important nuances here, most notably that this is the first time a hyperscaler has funded expansion of this magnitude primarily through debt.

Unlike Microsoft (MSFT), Amazon (AMZN), or Alphabet (GOOGL), Oracle’s balance sheet and cash flows aren’t strong enough to finance everything its backlog now implies. Ironically, the stock trades at a valuation premium well above those of its peers, despite carrying far greater risk. That disconnect makes me uncomfortable. With so much optimism already priced in, I see a higher likelihood of Oracle underperforming—hence, I lean toward a Sell rating.

Oracle Joins the Cloud Gang

The “big three” in cloud computing—AWS, Azure, and Google Cloud—might soon become the “big four” with Oracle Cloud’s unexpected rise. In early September, Oracle’s market value skyrocketed after it stunned investors with signals of massive demand for its cloud services.

In its latest earnings report, Oracle disclosed $455 billion in remaining performance obligations (RPOs)—more than 3.5x from the same period a year earlier. Of course, RPOs do not automatically mean money flowing into the company’s coffers immediately. In simple terms, it represents committed contracts and invoices not yet recognized as revenue—numbers that only become revenue once the services are delivered.

One might wonder how Oracle pulled off the feat of tripling its RPO in just one year, and how the market didn’t see it coming. To start with, Oracle has always been a software vendor in its DNA, not a massive hyperscaler—operating on a much smaller scale than its main peers. And the sudden shift from a predictable, cash-generative software business to a capital-intensive infrastructure builder is far from typical for a company like Oracle.

The key driver behind this explosive RPO growth was a handful of massive generative AI deals. The surge wasn’t spread across hundreds of smaller contracts—it came from a few giant, long-term agreements. Most notable is the $300 billion infrastructure deal with OpenAI, which includes building up to 4.5 gigawatts of U.S. data-center capacity over five years, starting around 2027.

As a result, Oracle’s backlog jumped overnight, reaching $455 billion—now the highest RPO among major hyperscalers, surpassing Microsoft at $368 billion, Amazon at $195 billion, and Alphabet at $106 billion.

The Fragile Side of Oracle’s Cloud Story

To be clear, having the largest backlog among hyperscalers doesn’t mean guaranteed success. Not all backlog is immediately realizable—some of it can take years to turn into revenue, and there’s always a risk of revisions or even cancellations along the way.

Unlike the “big three,” Oracle Cloud’s backlog is far more concentrated in a few gigantic contracts. That brings dependency and execution risk, making its RPO numbers potentially more volatile. And considering OpenAI’s symbiotic relationship with Microsoft—where Azure remains OpenAI’s primary cloud provider and Microsoft holds the exclusive license to commercialize OpenAI’s models in its own products—it’s reasonable to assume that these contracts with Oracle likely passed through Microsoft’s sieve first.

Microsoft CEO Satya Nadella remarked last quarter about a “huge adverse selection problem today,” referring to tech companies using venture capital money to buy GPUs—a clear hint at speculative demand for AI capacity. In essence, building data centers for that kind of demand is like lending money to customers who might not be able to repay it. That’s not to say OpenAI falls into that category, but it certainly implies a high degree of execution risk.

But having said that, the key difference between Oracle Cloud and its larger peers lies in financial depth. Oracle simply doesn’t have the same level of cash-flow generation to fund tens (or hundreds) of billions in CapEx without resorting to leverage. Over the last twelve months, Oracle generated $21.5 billion in operating cash flow and spent $27.4 billion on CapEx. To sustain this expansion, the company’s net debt jumped from $83.7 billion in May 2024 to $100.6 billion over the past twelve months.

In short, Oracle is now leaning heavily on leverage to secure the capacity it needs to meet its RPO—commitments that, by nature, are more volatile and speculative than those of its peers.

Valuation Breaks the Hyperscale Logic

The last but certainly not least point in Oracle’s “emerging hyperscaler giant” thesis is valuation. To capture the massive demand implied by its record RPO, Oracle will need to finance expansion through higher debt, heavier CapEx, and reduced short-term liquidity—risks its peers don’t necessarily share. In theory, that should mean ORCL trades at a discount.

But that’s not what’s happening. Following the August quarter re-rating, Oracle’s forward P/E jumped from around 33x to 40.4x, now well above Microsoft’s and Amazon’s ~33x and far above Alphabet’s 25x. To me, it makes little sense for Oracle—a company now leaning on leverage to fund a far riskier, capital-intensive cloud pivot—to trade at a premium to peers with stronger balance sheets and steadier cash flows.

Is ORCL a Buy, Hold, or Sell?

Despite the seemingly stretched valuation, the Street is still leaning bullish on ORCL. Over the past three months, 25 of 36 analysts have rated it a Buy, ten a Hold, and just one a Sell. The average price target of $354.13 suggests roughly 29% upside from current levels over the coming year.

Building the Cloud on Credit

While Oracle is boldly repositioning its growth story—and the surge in RPO undeniably gives it a higher, and to some extent deserved, level of credibility in the cloud space—the thesis carries significantly greater risks than those of its peers.

The issue isn’t Oracle’s ability to capitalize on secular demand, but rather how it’s funding that growth. For the first time, several billion in AI infrastructure spending will be financed largely by debt rather than cash flows, which is a risky precedent. And I wouldn’t rule out the possibility that this approach could spread to other tech names lacking the balance sheet strength and cash generation of Microsoft, Amazon, or Alphabet.

This doesn’t mean the strategy won’t work for Oracle—but I question whether the excessive optimism embedded in its current valuation versus peers is justified. For that reason, I remain Bearish on the stock.