Power semiconductor specialist Navitas Semiconductor (NVTS) saw its shares soar 21% on October 13 and another 26% the following day after revealing major progress in developing 800 VDC power devices for Nvidia (NVDA). This announcement marks a key milestone in Navitas’s transition from a consumer electronics player to a strategic enabler of the AI infrastructure revolution.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Despite an impressive 250% year-to-date rally, the company’s long-term growth story remains compelling. Navitas’s advanced gallium nitride (GaN) and silicon carbide (SiC) technologies are designed to deliver higher efficiency, greater power density, and lower energy losses—capabilities that are becoming critical as global data centers struggle to keep pace with AI’s skyrocketing energy requirements.

As the demand for ultra-efficient power conversion accelerates, Navitas is positioned to benefit from its early-mover advantage in high-voltage architectures and its strategic collaborations with major industry players like Nvidia. I remain Bullish on Navitas’s outlook and believe the company has a long runway for expansion as it scales production, deepens partnerships, and moves closer to commercializing its next-generation 800V data center solutions.

Why 800V Technology Puts Navitas in the Spotlight

My bullish outlook on Navitas stems from the surging power demands of AI technology. According to the International Energy Agency, global data center electricity consumption is projected to double from around 415 TWh in 2024 to 945 TWh by 2030.

During Navitas’s Q2 earnings call, CEO Eugene Sheridan noted that AI processor power consumption is expected to increase tenfold over the same period—from 7 GW in 2023 to more than 70 GW by 2030. These soaring energy requirements are forcing data center operators to prioritize efficiency—and that’s where 800V technology becomes critical.

Unlike traditional 48V or 12V data center architectures, 800V systems deliver substantially greater energy efficiency by minimizing power losses. Estimates suggest that 800V designs can achieve conversion efficiencies above 98% at high loads.

They also support far higher power density—a key enabler for next-generation AI workloads. While 48V setups typically manage 100–200 kilowatt racks, 800V architectures can handle over 1 megawatt per rack, unlocking a new level of scalability and performance for modern data centers.

Navitas Leverages GaN and SiC to Power Data Center Expansion

Navitas appears well-positioned to capitalize on the rising demand for 800V data center architectures by leveraging its proven technology base. Before pivoting toward the AI power market, the company built its expertise in the consumer electronics space, developing gallium nitride (GaN) power ICs and silicon carbide (SiC) diodes that enabled fast charging for smartphones and laptops.

Now, Navitas is applying both GaN and SiC technologies to its 800V data center solutions, where they offer clear advantages over traditional silicon chips in high-efficiency, high-power applications. Instead of betting on an entirely new technology, Navitas is building on its existing strengths to expand into the data center market, a strategy that meaningfully lowers execution risk while opening the door to significant growth.

NVTS’s 800V Data Center Breakthrough Including Scalable Manufacturing

Further reinforcing my bullish outlook on Navitas, the company announced significant progress in its 800V data center architecture on October 13. According to the update, Navitas is steadily building the foundational elements of this technological shift.

In the first stage, it will use its GeneSiC technology to design solid-state transformers that convert grid power into 800V DC. In the second stage, leveraging its 650V GaN chip portfolio, Navitas says it will develop solutions to step down 800V power to meet data center rack requirements. Finally, to power GPUs at the server level, the company has introduced a new 100V GaN FET portfolio.

Navitas’s ambitions extend beyond innovation—they’re about scale. To capture the vast market potential in AI power infrastructure, the company is investing in scalable manufacturing capabilities. It recently partnered with Powerchip to enhance production efficiency, transitioning from 6-inch wafers supplied by Taiwan Semiconductor Manufacturing Company (TSM) to 8-inch wafers.

According to company filings, this shift could boost chip output per wafer by roughly 80%, enabling Navitas to scale its 800V architecture rapidly and position itself as a key supplier to large-scale data center operators.

Is NVTS a Buy or Sell?

On Wall Street, NVTS stock carries a Moderate Buy consensus rating based on three Buy, three Hold, and one Sell ratings over the past three months. NVTS’s average stock price target of $8.88 implies ~43% downside potential over the next twelve months. Clearly, Wall Street analysts are expecting a retracement of this week’s gains.

Although analyst price targets paint a transitory picture of NVTS’s bullishness, I believe upward revisions are likely in the future when Navitas announces further progress from its 800V data center architecture efforts.

So far, Nvidia has partnered with Navitas to advance these developments. Once real-world applications of the 800V architecture are ready for evaluation, I anticipate other major data center operators will follow suit, partnering with Navitas to power their next-generation facilities. Such momentum could justify premium valuation multiples for the company in the near future.

For now, Navitas Semiconductor (NVTS) remains in the red, with earnings still negative as the company invests heavily in research, development, and scaling production. However, analysts project a steep earnings ramp-up over the next few years. Based on current forecasts, NVTS’s projected 2028 earnings per share imply a forward P/E ratio of roughly 300x—a valuation that reflects both the company’s early-stage growth phase and investors’ high expectations for its technology to gain meaningful traction in the AI power market.

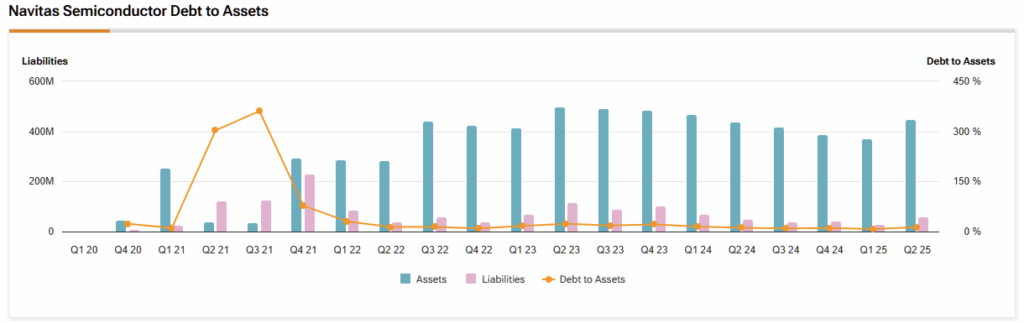

The company currently commands a market capitalization of over $3 billion, supported by a solid balance sheet that includes $161 million in cash against only $7 million in debt. This financial flexibility gives Navitas room to continue funding expansion, ramp up production of its 800V and GaN-based power solutions, and pursue strategic partnerships without immediate pressure to raise additional capital. While the valuation may appear stretched on traditional metrics, it mirrors the market’s confidence in Navitas’s potential to make a splash in AI infrastructure sometime in 2028.

Navitas Poised to Ride the AI Power Wave with Breakthrough 800V Tech

Navitas Semiconductor appears well-positioned to capitalize on the surging power demands driven by AI. The company is leveraging its proven technologies to develop 800V data center architectures that could see broad adoption among large-scale operators over time.

As outlined in its October 13 announcement, Navitas has already made meaningful strides toward making 800V data center infrastructure a reality. I remain bullish on Navitas’s outlook, as the company stands at the threshold of a long growth runway, moving toward the commercialization of its 800V technology.