Tesla (TSLA) CEO Elon Musk excited investors in July when he said robotaxis would soon expand from a small pilot program in Austin, Texas, to new markets like the San Francisco Bay Area. On X, he even suggested the rollout could happen in “a month or two.” However, the EV maker had not actually applied for the permits needed to launch autonomous ride-hailing in California, according to Reuters. Instead, the company arranged invite-only rides in human-driven vehicles under a permit typically used for limousine services. As a result, regulators were caught off guard and quickly became concerned.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Indeed, emails obtained by Reuters show that both state and federal officials were alarmed after reports claimed Tesla would launch driverless taxis in the Bay Area. California’s Public Utilities Commission later reminded Tesla that it must clearly separate its human-driven ride services in the state from autonomous operations elsewhere. Despite this, Musk continued to use the term “robotaxi” and posted that Tesla’s service areas in Austin and the Bay Area were already larger than competitors’, even though no fully driverless cars were operating.

Unsurprisingly, this language led to confusion and raised questions about how Tesla communicates its plans. Nevertheless, the stakes are high for the company because robotaxis are central to Musk’s long-term vision for Tesla, and are what are supporting the firm’s $1 trillion valuation. It is also worth noting that, for nearly a decade, Musk has promised imminent robotaxi launches, but so far, only small-scale tests in Austin with safety monitors in the passenger seat have materialized.

What Is the Prediction for Tesla Stock?

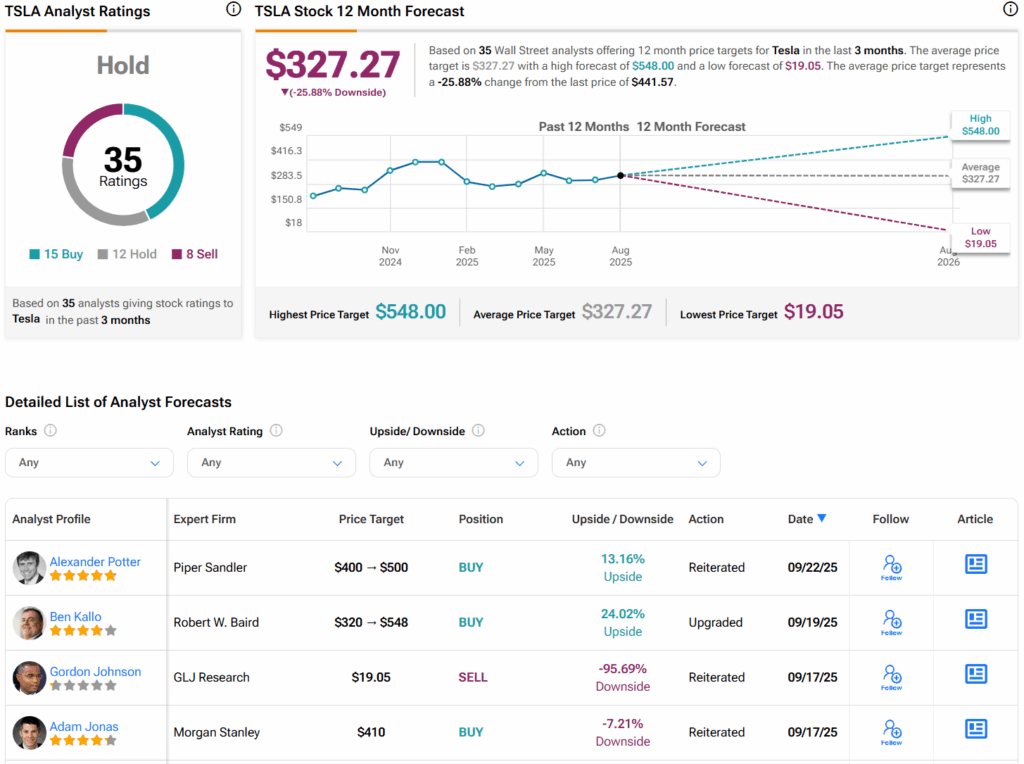

Turning to Wall Street, analysts have a Hold consensus rating on TSLA stock based on 15 Buys, 12 Holds, and eight Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average TSLA price target of $327.27 per share implies 25.9% downside risk.