GameStop (GME) stock remains wildly volatile — euphoric one day, punishing the next. Bulls whisper of another meme-fueled rally, while bears anticipate a familiar fade. I lean bearish: the core retail business continues to erode, and though a Bitcoin pivot might have revived a cash-rich zombie, execution so far has been uneven and opaque. It’s a story that excites on social media but falls flat in the filings.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

GME’s Core Business Keeps Struggling

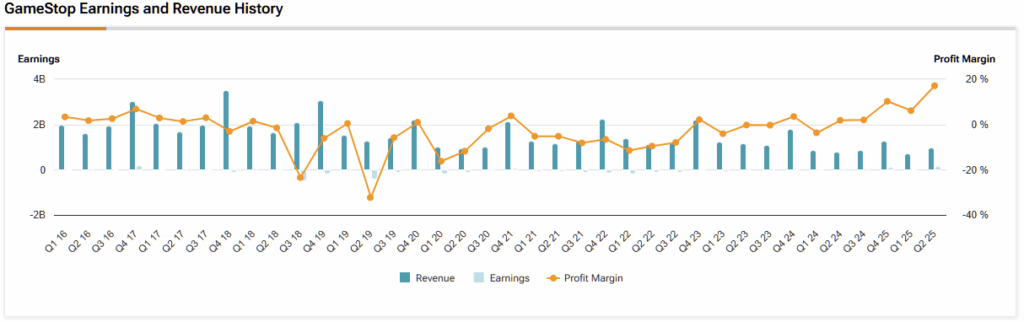

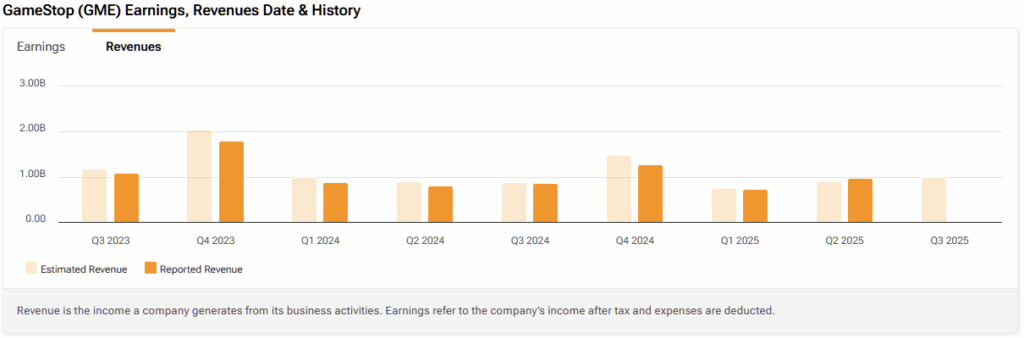

First things first, the retail core still erodes beneath the hype. During the last quarter, net sales totaled just $972.2 million. While hardware and accessories increased to $592.1 million and collectibles rose to $227.6 million, higher-margin software declined 27% to $152.5 million. Therefore, the already low gross margin compressed further to 29.1% from 31.2% a year ago, once again diminishing the company’s chances of having a real, profitable business over the long term.

In the meantime, management again skipped a conference call, leaving us to speculate about the strategy from here. The filings show cost cuts, but also indicate that GameStop’s footprint is being scaled back, as the company sold its Canadian operations in May and is currently holding its French operations for sale. The structural current still runs against specialty retail, as digital downloads and subscription ecosystems continue to siphon transactions away from stores, so margins are likely to stay under pressure unless the mix flips back toward software.

Hardware spikes may boost the top line, but they weigh heavily on the P&L. This quarter leaned on consoles and collectibles — strong for revenue optics but weak for profitability, with software sales still in decline. As store consolidation continues, sustaining durable, high-margin profits from the legacy model looks increasingly complex.

The Bitcoin Pivot is Missing a Playbook

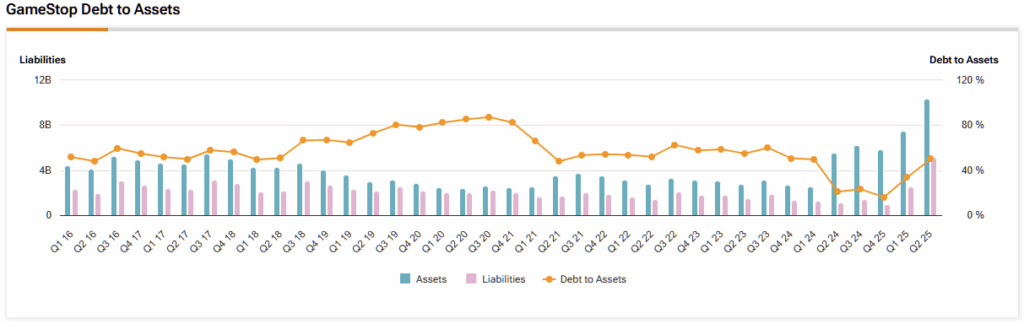

Now, as you may remember, in late March, GameStop’s board updated its capital allocation policy to add Bitcoin as a treasury reserve asset. On May 28, GameStop disclosed buying 4,710 BTC (about $513 million then), and by Q2 close, reported $528.6 million of Bitcoin on the balance sheet. The problem is that we have not seen a steady or predictable accumulation pattern, despite the significantly larger capital raises.

Consider the fund-raising stack itself. In May 2024, an ATM raised $933.4 million; in June, another brought in $2.137 billion; and by September, a third added about $400 million. In 2025, the company turned to zero-coupon converts, issuing $1.3 billion on March 27 and an upsized $2.25 billion on June 12.

Yet by Q2 2025, the company’s Bitcoin holdings stood at just $528.6 million, meaning the bulk of these freshly raised billions had not been deployed into BTC. Management has provided no clear targets, timelines, or guardrails, leaving investors without a consistent framework for its stacking strategy.

Earlier this month, the company issued a warrant dividend — one warrant for every ten shares, with a strike price of $32 and an expiration date of October 30, 2026. If fully exercised, it could raise roughly $1.9 billion (up to about 59 million new shares). It’s another clever financing valve, but it reinforces the same “raise now, decide later” approach. If management truly aimed for a Strategy (MSTR)-style blueprint, investors would see a steady, pre-announced stacking plan with clear public guardrails. So far, that’s absent.

Price Above Book, With a Drag

The issue is that valuing GME based on earnings feels like chasing smoke, as retail is wobbling, and the crypto angle isn’t as well-paced as a treasury strategy. Book value per share is a cleaner anchor, which stood at around $11.56 at the end of the last quarter, while the stock trades at nearly 2.3x book value. You can see why that’s rich for a retailer with compressing gross margins and a shrinking high-margin category.

Even if you want this as a BTC proxy, you’re paying a premium to book and inherit a legacy retail engine that likely drags down intrinsic value, the kind of setup that usually deserves a discount, not a markup. Without a consistent, transparent accumulation tempo, the premium will simply not work over the long term.

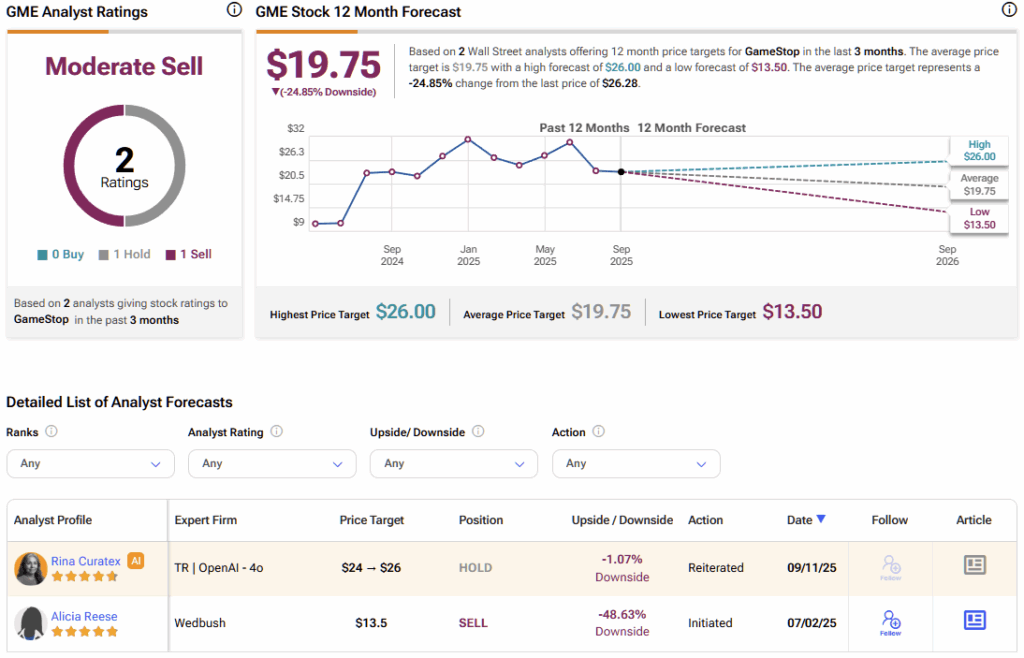

Therefore, unless the company commits to a methodical BTC stacking policy or the core mix shifts back toward higher-margin software, there’s little justification for paying a multiple that assumes sturdier earnings than the filings suggest. This is why I don’t think you should be surprised if short sellers, assuming no bull mania takes over social media and, in my view, unjustifiably sends shares higher.

Is GameStop a Buy, Hold, or Sell?

There are just two analysts offering price targets on GME stock via TipRanks over the past three months. One is bearish and one is neutral. GME’s average stock price target is currently $19.75, implying almost 25% downside over the next twelve months. This price target also aligns with my view that shares shouldn’t be trading at today’s book value premium.

Filings Beat Vibes: The Bearish Case Wins on GME

Could another burst of meme energy lift the stock? Of course — mania needs no permission. But filings outweigh vibes. Q2 revenue showed some spark, yet margins deteriorated, software sales kept shrinking, and the Bitcoin strategy remains ad hoc with no clear cadence or target allocation. To make matters worse, shares continue to trade well above book value.

I had hoped for a true cash-to-crypto treasury transformation. Instead, what has emerged is episodic financing, sporadic coin buys, and a core business still eroding at its edges. For that reason, I see recent strength as an opportunity to sell.