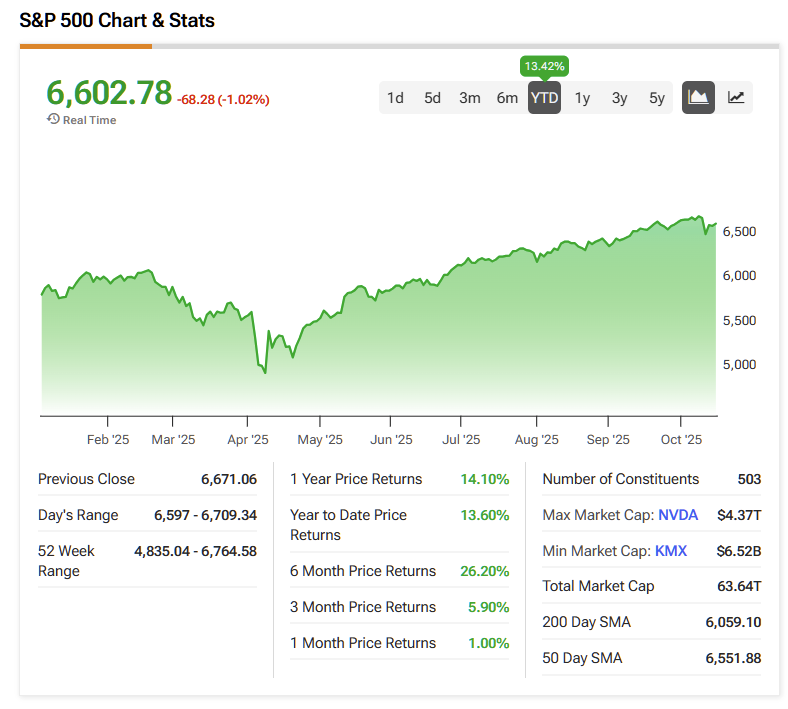

With the S&P 500 (SPX) surging 26.2% and the Nasdaq (NDX) soaring 38.2% over the past six months, there’s no denying that stocks are on a tear. This powerful rally has pushed the S&P 500’s valuation to roughly 23x forward earnings—well above its historical average—leaving many investors struggling to find fresh opportunities in an overheated market.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Still, value can be found for those willing to look beyond the high-flyers. One area that’s been largely overlooked in the recent rally is healthcare. The Health Care Select Sector SPDR Fund (XLV), which tracks the S&P 500’s healthcare stocks, has gained just 3.2% over the same period—far behind the broader market. Within the sector, several major names are trading at attractive valuations and offering generous dividend yields. Among them, Bristol-Myers Squibb (BMY) stands out, down 14.3% over the past six months and hovering just above its 52-week low.

I’m Bullish on BMY due to its exceptionally low valuation and strong dividend yield, making it an appealing option for value-oriented and income-focused investors in today’s exuberant market.

What is Bristol-Myers Squibb (BMY)?

Founded in 1887 and headquartered in Princeton, New Jersey, Bristol-Myers Squibb is one of the world’s largest and most established healthcare companies, boasting a market capitalization of roughly $90 billion. Over its long history, the company has built a diverse portfolio spanning oncology, immunology, cardiovascular disease, and virology.

BMY is best known for its blockbuster therapies that have reshaped modern medicine, including Opdivo, a leading immunotherapy used to treat multiple forms of cancer; Eliquis, a top-selling anticoagulant that helps prevent strokes and blood clots; and Revlimid, a widely used cancer treatment that continues to be a significant revenue contributor. Together, these drugs form the backbone of Bristol-Myers Squibb’s global franchise and underscore its reputation as a powerhouse in medical therapies.

Current Challenges

Bristol-Myers Squibb’s blockbuster drugs have delivered tremendous success over the years, but looming patent expirations are weighing heavily on the stock. The company will lose exclusivity for Revlimid in 2026 and Eliquis in 2028, exposing both drugs to generic and biosimilar competition. Opdivo’s original formulation will also lose exclusivity in 2028 and face Medicare price negotiations in 2029, though newer formulations are expected to help cushion the blow. According to Morningstar (MORN), approximately 47% of BMY’s total revenue is at risk from patent expirations through 2028 — a sobering figure that explains much of the market’s caution.

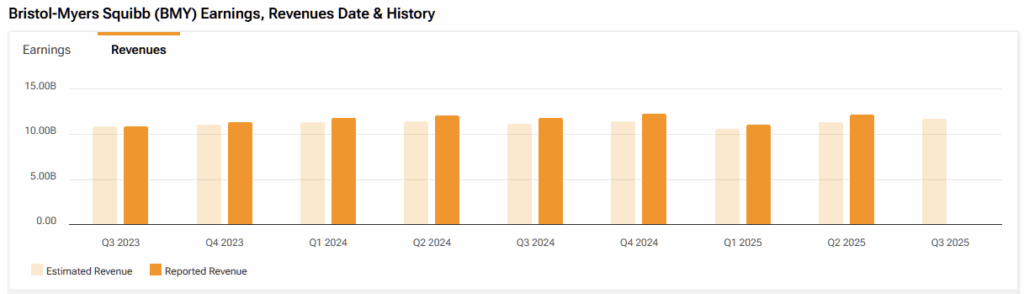

Still, the company isn’t standing still. BMY classifies its drugs into a Legacy Portfolio (which includes its mature blockbusters) and a Growth Portfolio of newer treatments. In the latest quarter, revenue from the Legacy Portfolio declined 14% year over year (15% in constant currency), while the Growth Portfolio — driven by promising therapies such as Breyanzi, Reblozyl, Camzyos, and Cobenfy — climbed 18% (17% constant currency). While total revenue growth remained largely flat, the momentum in newer drugs suggests that continued expansion in this segment could eventually offset declines in legacy products and reignite overall growth.

Beyond its internal pipeline, Bristol-Myers Squibb has also been pursuing strategic acquisitions to strengthen its future product lineup. Most recently, on October 10, the company announced the acquisition of privately held Orbital Therapeutics, a pioneer in next-generation RNA medicines designed to reprogram the immune system in vivo. While it remains to be seen whether this or other deals will deliver material results, the move underscores BMY’s proactive approach to replenishing its pipeline and securing long-term growth.

At current valuations, expectations for the stock are already quite low — suggesting that much of the bad news may already be priced in. This could leave room for meaningful upside if BMY’s growth initiatives start to gain traction in the coming quarters.

BMY’s Deep Discount Leaves Room for a Rebound

Bristol-Myers Squibb’s shares are trading at remarkably low levels: less than 7x 2025 earnings estimates, or roughly one-third the S&P 500’s forward multiple of about 23x. This deep discount suggests the market has already priced in a significant amount of bad news, providing meaningful downside protection for investors.

At such depressed valuations, expectations are minimal, and the risk/reward balance looks increasingly favorable. If the company can stabilize earnings and offset revenue losses from Revlimid and Eliquis, there’s considerable potential for multiple expansion — and with it, a strong rebound in the stock’s valuation.

Reliable 5.7% Dividend Powerhouse for Income Investors

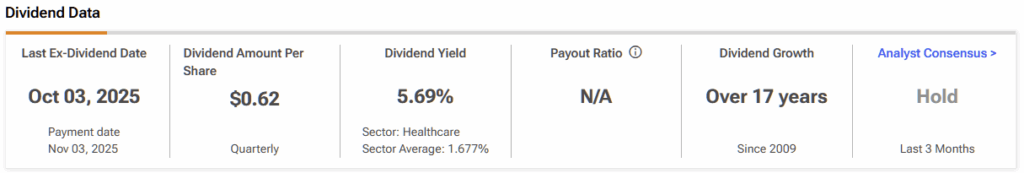

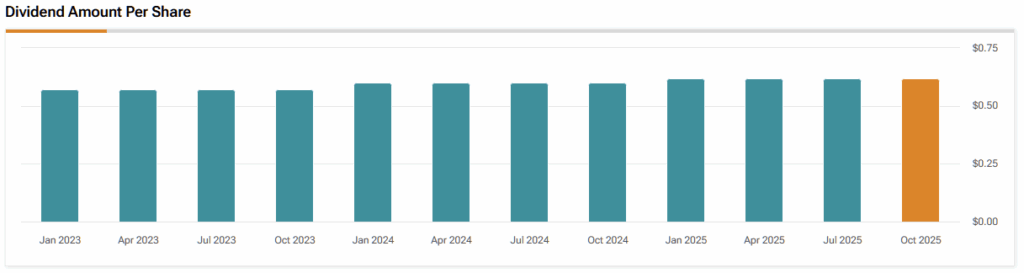

Bristol-Myers Squibb offers a standout dividend yield of 5.7%, far exceeding the S&P 500’s average yield of 1.3% and the healthcare sector’s average of 1.7% (as represented by the XLV ETF). The company also boasts a long track record of rewarding shareholders — it has paid a dividend for 36 consecutive years and has raised its payout for 17 straight years.

Importantly, this isn’t a case of a dangerously high yield masking weak fundamentals. With a payout ratio below 40%, BMY’s dividend is well-covered and sustainable.

Taken together, the stock’s robust yield, reliable history of dividend growth, and conservative payout make Bristol-Myers Squibb an attractive choice for income-focused investors seeking both stability and long-term value.

Is BMY a Good Stock to Buy?

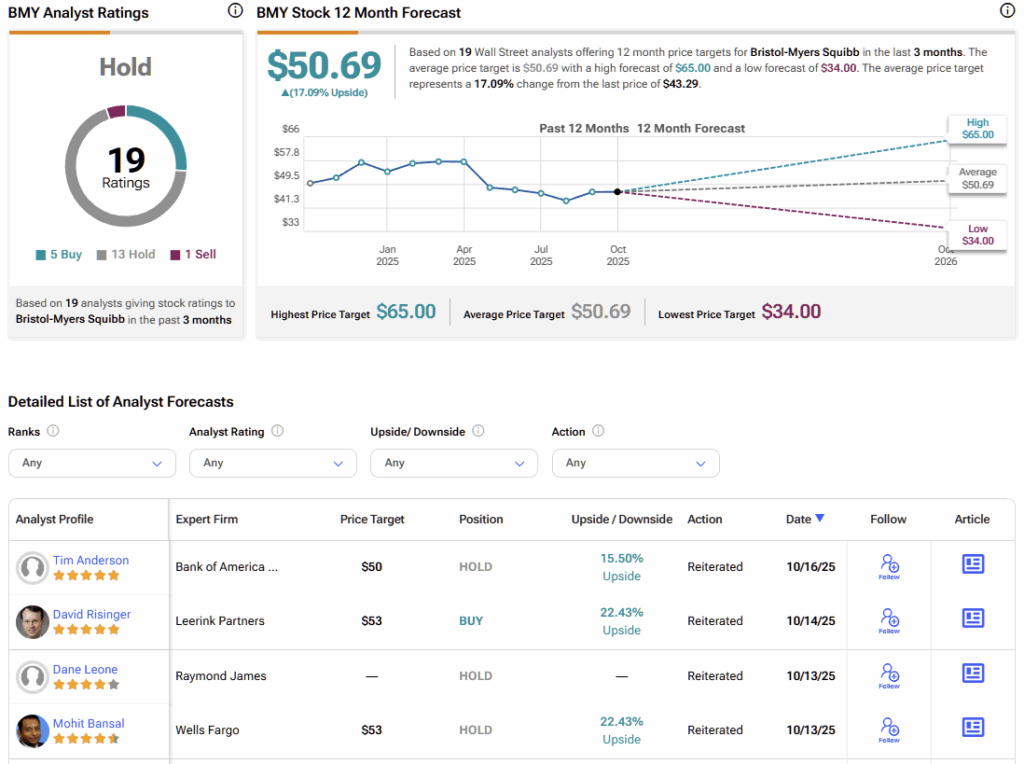

Turning to Wall Street, BMY earns a Hold consensus rating based on five Buys, 13 Holds, and one Sell rating assigned in the past three months. The average BMY stock price target of $50.69 implies more than 17% upside potential over the next 12 months.

Undervalued, High-Yield, and Poised for a Turnaround

I’m bullish on Bristol-Myers Squibb. While the company faces notable patent expirations ahead, its current valuation — trading at under 7x forward earnings — more than accounts for those challenges. At these deeply discounted levels, downside risk appears limited, while the upside potential is significant if newer drugs continue to offset declines from legacy products or drive fresh revenue growth. Coupled with a strong 5.7% dividend yield, BMY stands out as an attractive opportunity for both value and income-focused investors.

Looking ahead, the company is set to report Q3 earnings at the end of October, and continued momentum in its Growth Portfolio would be an encouraging signal of progress. Given the stock’s modest valuation multiple, the market has already priced in most of the near-term headwinds — leaving room for positive surprises to move the stock higher.