Chinese tech firm Alibaba (BABA) is stepping up its efforts to grow AliExpress, its global e-commerce site, by targeting well-known brands that currently sell on Amazon (AMZN). To win them over, Alibaba is offering lower shipping costs and taking a smaller cut of sales than Amazon does. The goal is to make AliExpress more attractive to both brands and customers, especially in key international markets like Europe and Latin America, where it has struggled to compete with the e-commerce giant.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

As part of this push, Alibaba is also looking to bring more brands from its domestic platform, TMall, onto AliExpress. While the site already features big Chinese names like Xiaomi and Pop Mart, Alibaba wants to expand its lineup with more global companies. This strategy comes at a time when rivals like Temu, owned by PDD Holdings (PDD), and Shein have gained strong traction in Western markets. Indeed, their success has added pressure on Alibaba to make AliExpress a bigger player outside of China.

However, Alibaba’s expansion faces some challenges. To begin with, President Trump’s administration has raised tariffs on small packages from China, which has created a tougher environment for platforms like AliExpress. Meanwhile, although Alibaba’s overseas e-commerce business saw 19% revenue growth last quarter, it still hasn’t turned a profit. And despite the firm’s new focus on AI, Alibaba continues to rely heavily on e-commerce, thereby making AliExpress’s success critical for the firm.

Is BABA Stock a Good Buy?

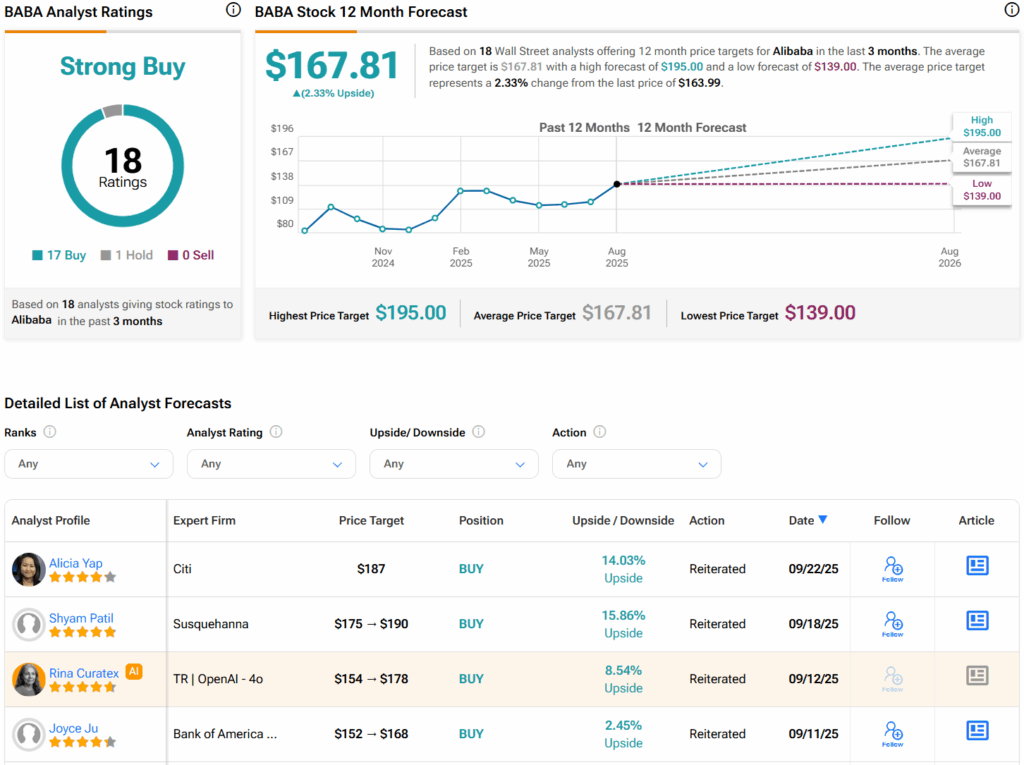

Turning to Wall Street, analysts have a Strong Buy consensus rating on BABA stock based on 17 Buys, one Hold, and zero Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average BABA price target of $167.81 per share implies 2.3% upside potential.