Heavy machinery manufacturer Caterpillar (CAT) has been getting a major boost from the AI boom. More specifically, the company’s power generators and turbines, which are essential for keeping data centers running, are in high demand as artificial intelligence infrastructure expands globally. As a result, Caterpillar shares hit an all-time high today after it reported that sales of those products jumped 31% in the latest quarter, way higher than its traditional equipment business.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

This surge demonstrates how the AI industry is also influencing older industrial firms. At Caterpillar, the data center boom has transformed what was once a quieter corner of its business. In fact, its Energy & Transportation unit—responsible for selling generators, oil and gas equipment, and rail machinery—has now become its largest and fastest-growing division, accounting for around 40% of total revenue last year.

Moreover, Caterpillar said the segment’s overall sales rose by 17% year-over-year, with some analysts predicting that revenue could double or even triple in the years ahead. Separately, energy companies that provide power to data centers have also benefited greatly. One example is Constellation Energy (CEG), a nuclear power generator in the U.S. that has signed long-term power purchase agreements with tech giants. Thanks to these deals, shares of CEG have rallied an impressive 80% on a year-to-date basis.

Is Caterpillar Stock a Buy, Sell, or Hold?

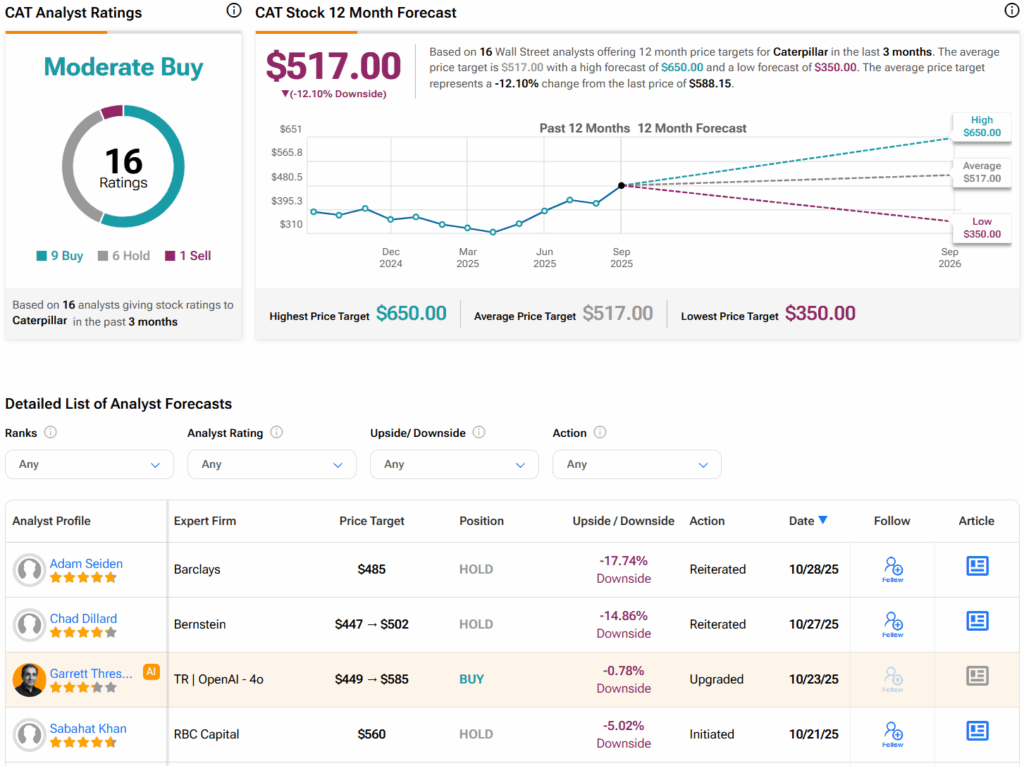

Turning to Wall Street, analysts have a Moderate Buy consensus rating on CAT stock based on nine Buys, six Holds, and one Sell assigned in the past three months, as indicated by the graphic below. Furthermore, the average CAT price target of $517 per share implies 12.1% downside risk.