Shares of branded food products provider Hormel Foods (NYSE:HRL) are trending marginally higher today after the company announced its results for the fourth quarter. Revenue declined by 2.4% year-over-year to $3.2 billion, missing expectations by $60 million. Similarly, EPS of $0.42 lagged estimates by $0.02.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

During the quarter, volume in the Retail segment declined by 3%. While the company’s Jennie-O-turkey portfolio is witnessing a recovery, it experienced declines in the convenient meals and proteins, and snacking and entertaining verticals.

In contrast, volume rose by 5% each in Hormel’s Foodservice and International segments. Additionally, an improved product mix led to a 13% rise in the Foodservice segment profit. Lower sales in China, coupled with a decrease in branded export volumes, led to a 12% decline in its International segment net sales.

Amid the present environment of slowing consumer demand and inflationary challenges, Hormel expects net sales in Fiscal year 2024 to rise by 1% to 3%. EPS for the year is anticipated to land between $1.51 and $1.65. Further, Hormel has increased its dividend for Fiscal year 2024 by 3% to $1.13 per share. Impressively, this marks the 58th consecutive annual dividend increase from Hormel.

What Is HRL Stock Target?

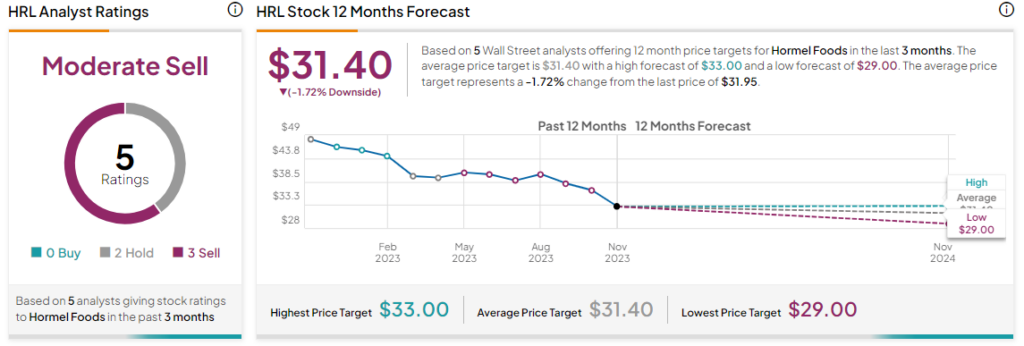

Overall, the Street has a Moderate Sell consensus rating on Hormel Foods. Following a nearly 35% decline in the company’s share price over the past year, the average HRL price target of $31.40 implies the stock may be fairly priced at current levels.

Read full Disclosure