Diversified technology and manufacturing company Honeywell (NASDAQ:HON) expects robust demand for new business jets in the coming decade. This may significantly boost its Aerospace business, which is growing rapidly, driven by solid organic sales.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The company is projecting the delivery of approximately 8,500 new business jets worth $278 billion between 2024 and 2033. Increased flight activity and fleet expansion should continue to drive these deliveries.

Investors should note that Honeywell’s Aerospace sales have registered double-digit organic sales growth over the past four consecutive quarters, driven by strength in commercial aviation. Further, solid demand and a strong backlog suggest that this segment is well-positioned to sustain its impressive growth trajectory.

Honeywell is reorganizing its business to capitalize on megatrends like automation, the energy transition, and the future of aviation (electrification). This will enable the company to accelerate organic sales growth. Moreover, the company’s Aerospace technologies are employed in almost all commercial and defense aircraft platforms, which augurs well for growth.

With this backdrop, let’s look at what the Street recommends for HON stock.

Is Honeywell a Buy, Sell, or Hold?

Honeywell stock is down about 13% year-to-date. However, strong demand and management’s focus on driving organic and inorganic growth will likely support its earnings in the coming quarters.

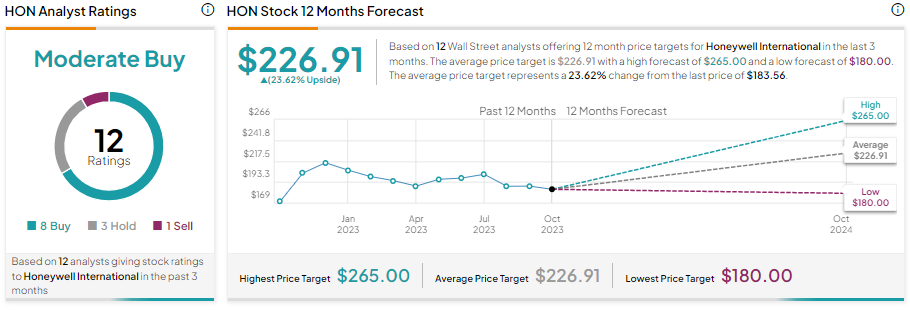

Currently, analysts maintain a Moderate Buy consensus rating on HON stock, reflecting eight Buy, three Hold, and one Sell recommendations. Analysts’ average 12-month price target of $226.91 implies 23.62% upside potential from current levels.