The Bankruptcy Court for the Western District of Pennsylvania has approved Honeywell’s (NASDAQ:HON) plan to end its funding obligations to the North American Refractories Asbestos Personal Injury Settlement Trust. The company will be making a lump sum payment of $1.325 billion.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

In order to end the liability, Honeywell will pay the estimated claims-related amounts to the trust from the $695 million NARCO reserve held on its balance sheet as of September 2022.

In connection with the deal, Honeywell will likely recognize a charge related to the settlement amount. This charge is expected to be offset by net proceeds from the acquisition of HarbisonWalker International Holdings (HWI) by Platinum Equity. HWI had emerged from the NARCO bankruptcy. Further, insurance proceeds in connection with the Trust’s asbestos-related insurance policies will also help to nullify the charge.

Honeywell is a company that offers energy, safety, and security solutions. It recently announced plans to make electric vehicles (EVs) safer by reducing the risk of thermal runaway in EV batteries, which causes the vehicle to catch fire.

Is HON Stock a Buy?

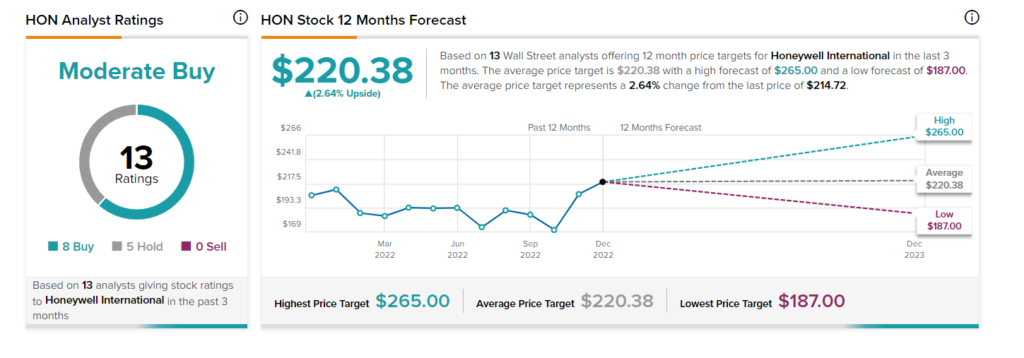

Wall Street is cautiously optimistic about HON stock, with a Moderate Buy consensus rating based on eight Buys and five Holds. The average Honeywell stock price target of $220.38 suggests 2.6% upside potential.